Overview

Navigating the world of Social Security Insurance Disability (SSDI) benefits can feel overwhelming. We understand that many individuals face significant challenges in this process. This article outlines a comprehensive five-step approach to help you understand and secure the benefits you deserve.

- First, we will discuss the eligibility criteria that determine who qualifies for SSDI benefits. Knowing these requirements can empower you to assess your situation more clearly.

- Next, we will guide you through the essential documentation needed for your application, ensuring you have everything in place.

- The application process can be daunting, but we aim to simplify it for you. By providing strategies to overcome common obstacles, we hope to ease your journey.

- It's common to feel frustrated or confused, but remember, you are not alone in this experience.

- Finally, we will address common challenges applicants face and offer encouragement to help you persevere.

Our goal is to empower you to successfully secure the financial support you need. You deserve this assistance, and we’re here to help you every step of the way.

Introduction

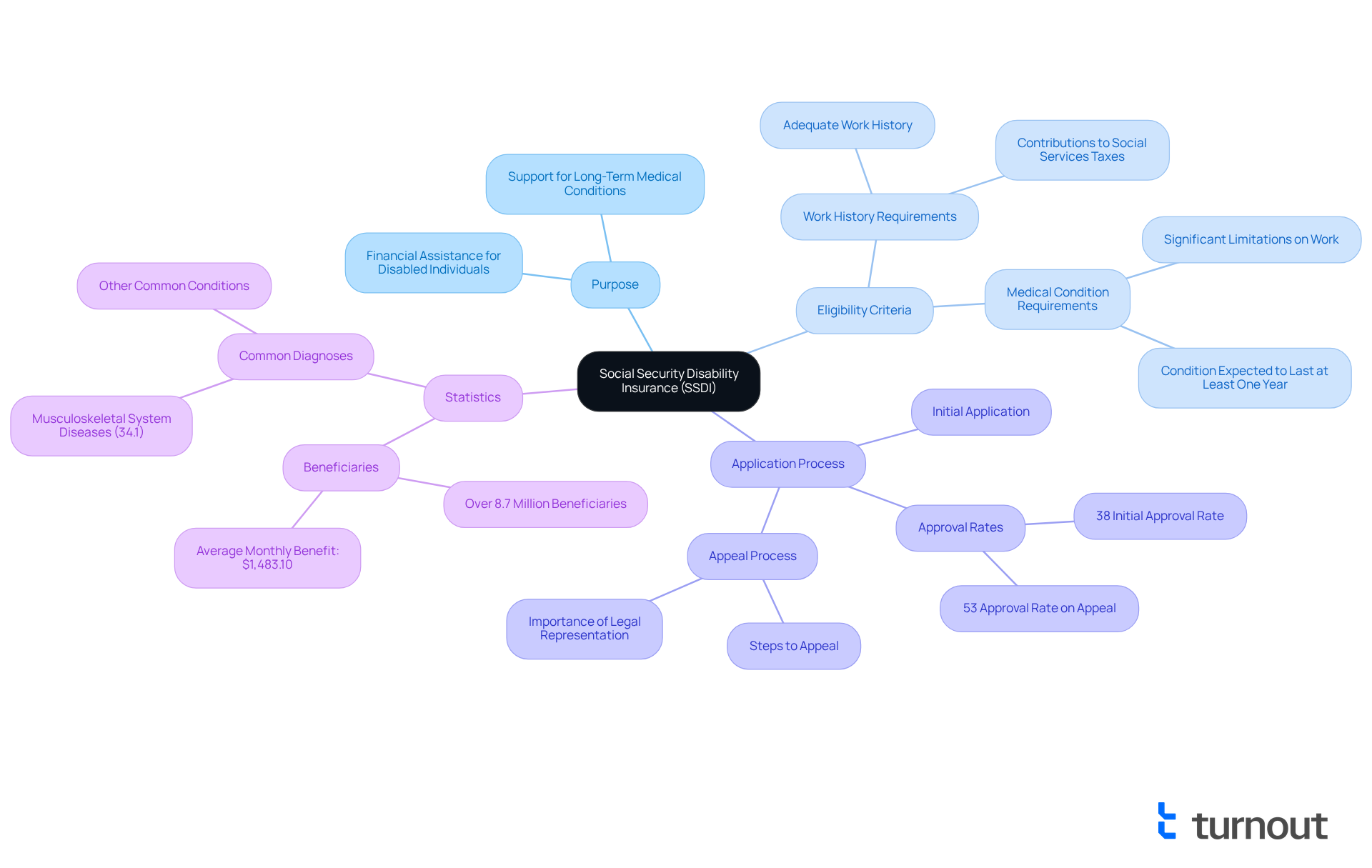

Navigating the maze of Social Security Disability Insurance (SSDI) can feel overwhelming for many individuals facing health challenges. With over 8.7 million beneficiaries relying on this vital program for financial support, understanding the application process is essential for securing the benefits you deserve. It's common to feel daunted by the complexities involved, especially considering that a staggering 65% of initial claims are denied. So, how can you effectively navigate these challenges to enhance your chances of approval?

This guide outlines five essential steps designed to demystify the process. We want to empower you to tackle your SSDI applications with confidence and clarity, knowing that you are not alone in this journey. Together, we can work through the intricacies of SSDI, ensuring that you are equipped with the knowledge and support needed to succeed.

Understand Social Security Disability Insurance (SSDI)

Social Security Insurance Disability (SSDI) is a vital federal program designed to provide financial assistance to individuals who are unable to work due to a medical condition expected to last at least one year or result in death, highlighting the importance of social security insurance disability. As of December 2023, over 8.7 million disabled beneficiaries received payments through social security insurance disability, underscoring the program's importance in offering essential income for those in need. To qualify, applicants must demonstrate an adequate work history and have contributed to Social Services taxes. The eligibility criteria for social security insurance disability are stringent, requiring that the condition significantly limits the ability to engage in substantial gainful activity.

We understand that navigating the SSDI approval process can be challenging. In recent years, only about 38% of initial applicants have met the technical criteria for acceptance. However, if you find yourself facing an initial denial, there is hope—approximately 53% of those who appeal are ultimately approved. This highlights the importance of understanding the application process and seeking assistance when needed.

Real-world examples illustrate the impact of social security insurance disability benefits. For instance, individuals with musculoskeletal system diseases, which account for 34.1% of diagnoses among disabled workers, often rely on social security insurance disability benefits to maintain financial stability while managing their health conditions.

Financial consultants emphasize the importance of understanding the eligibility criteria for social security insurance disability benefits. It's crucial for applicants to be aware of income thresholds and the necessary paperwork to substantiate their claims. By grasping these elements, you can navigate the application process more efficiently and increase your chances of receiving the support you deserve. Moreover, the typical monthly assistance for disabled individuals is around $1,483.10, further demonstrating the financial impact of this program. Remember, you are not alone in this journey, and we’re here to help you every step of the way.

Determine Your Eligibility for SSDI Benefits

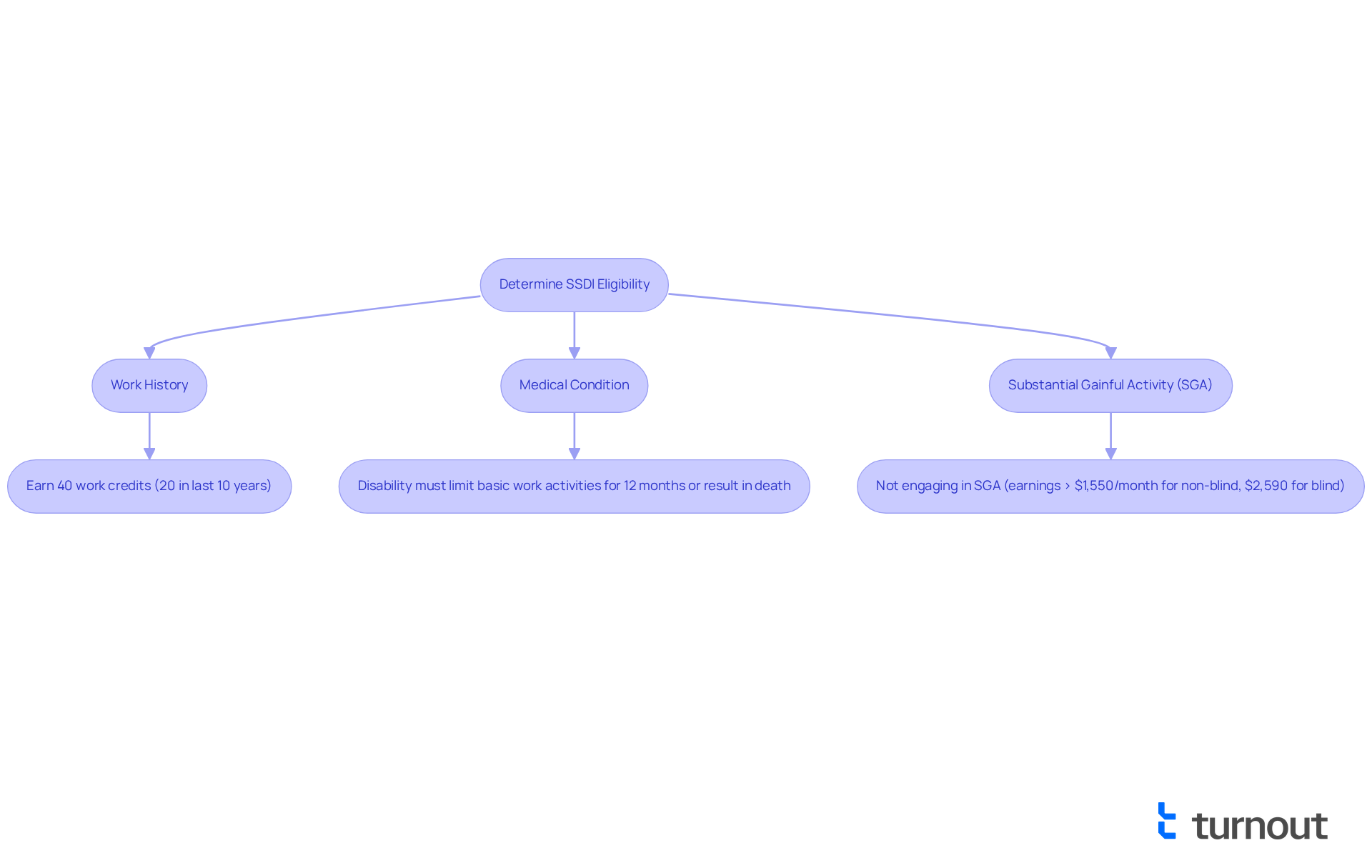

Assessing your eligibility for disability benefits can feel overwhelming, but we're here to guide you through the process. Consider these important criteria:

-

Work History: Typically, you need to have earned 40 work credits, with at least 20 of those earned in the last 10 years. In 2025, one credit is earned for every $1,810 in covered earnings, meaning you must earn at least $7,240 to obtain the maximum four credits.

-

Medical Condition: Your disability must align with the SSA's definition, which requires that it significantly limits your ability to perform basic work activities for at least 12 months or is expected to result in death.

-

Substantial Gainful Activity (SGA): It's essential not to be engaging in substantial gainful activity, defined as earning more than $1,550 per month for non-blind individuals and $2,590 for blind individuals.

We understand that comprehending the 2025 social security insurance disability eligibility changes is crucial for individuals seeking benefits. Familiarizing yourself with the SSA's guidelines can help verify your eligibility before moving forward.

Additionally, consulting with an experienced disability attorney can enhance your application and assist in navigating the updated requirements. Remember, examining your Social Security benefits earnings statements is also important to ensure you meet the updated work credit requirements. You're not alone in this journey, and there are resources available to help you along the way.

Gather Necessary Documentation for Your Application

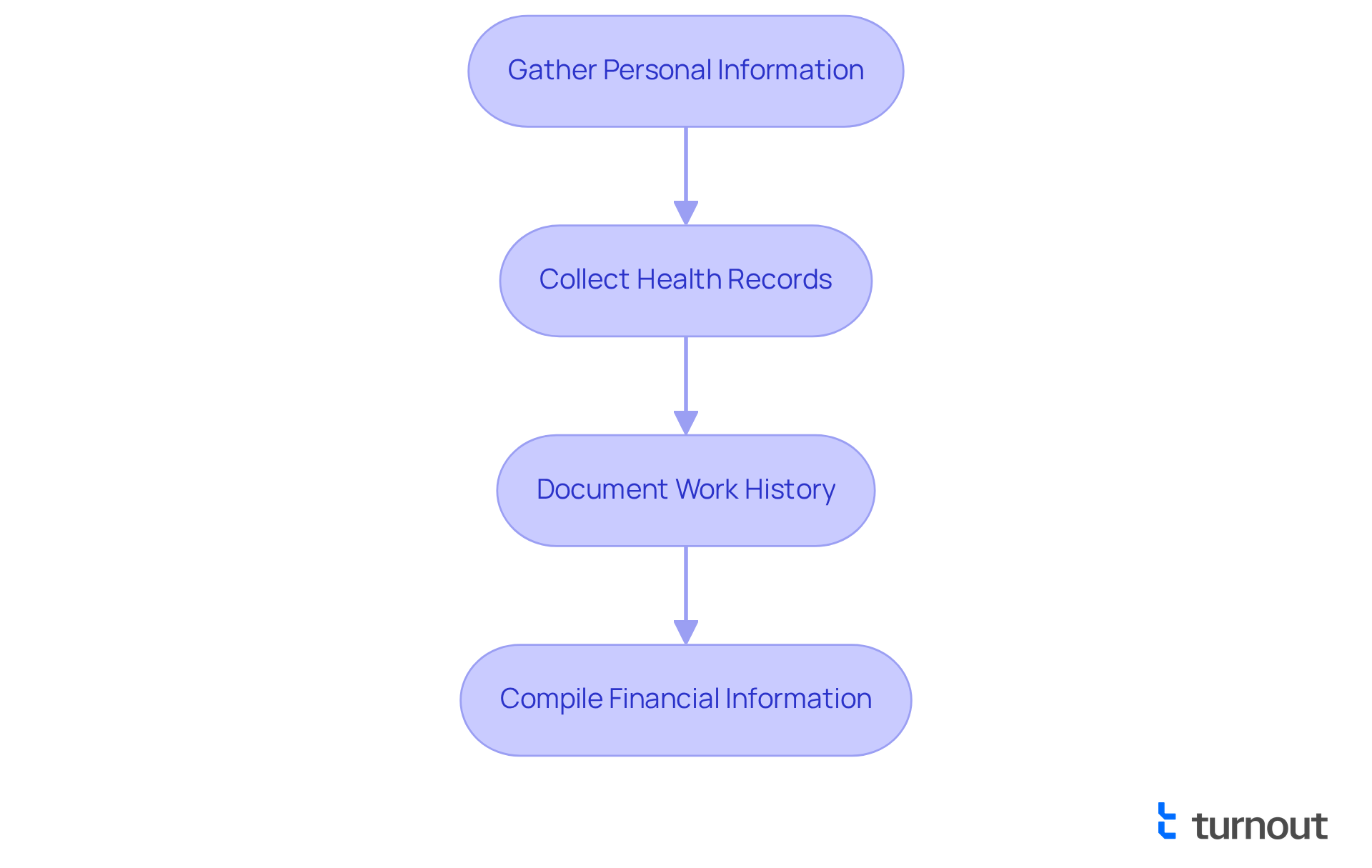

Applying for social security insurance disability can feel overwhelming, but gathering the right documentation can make the process smoother. Here’s what you need to collect:

- Personal Information: Make sure to include your Social Identification number, birth certificate, and proof of U.S. citizenship or lawful immigrant status.

- Health Records: Gather comprehensive health documentation from your healthcare providers. This should include your diagnoses, treatment history, and relevant test results. Detailed medical evidence is essential for SSD claims, as the Social Security Administration (SSA) relies heavily on this information to determine eligibility. Utilizing the Adult Disability Checklist can help ensure you have all the required information before submitting your application for benefits.

- Work History: Provide a detailed account of your employment history, including job titles, dates of employment, and descriptions of job duties. This information is crucial in establishing your work credits and eligibility for social security insurance disability benefits.

- Financial Information: Document any income, assets, and resources. This is particularly important for those applying for Supplemental Security Income (SSI), which has strict income limits.

Having these documents organized can significantly streamline your submission process. Many applicants face challenges due to inadequate health-related evidence, which can delay their claims. For instance, Tracy's successful SSDI request was largely credited to her thorough documentation, including detailed medical records and a clear work history. By ensuring all necessary information is collected, you can enhance your chances of a favorable outcome and reduce the time spent navigating the bureaucratic system.

If your request for disability benefits is denied, remember that you have the right to appeal within 60 days. Once you have collected all your documentation, the next step is to submit your request through the SSA's online portal, by phone, or in person. You're not alone in this journey; we're here to help you every step of the way.

Complete the SSDI Application Process

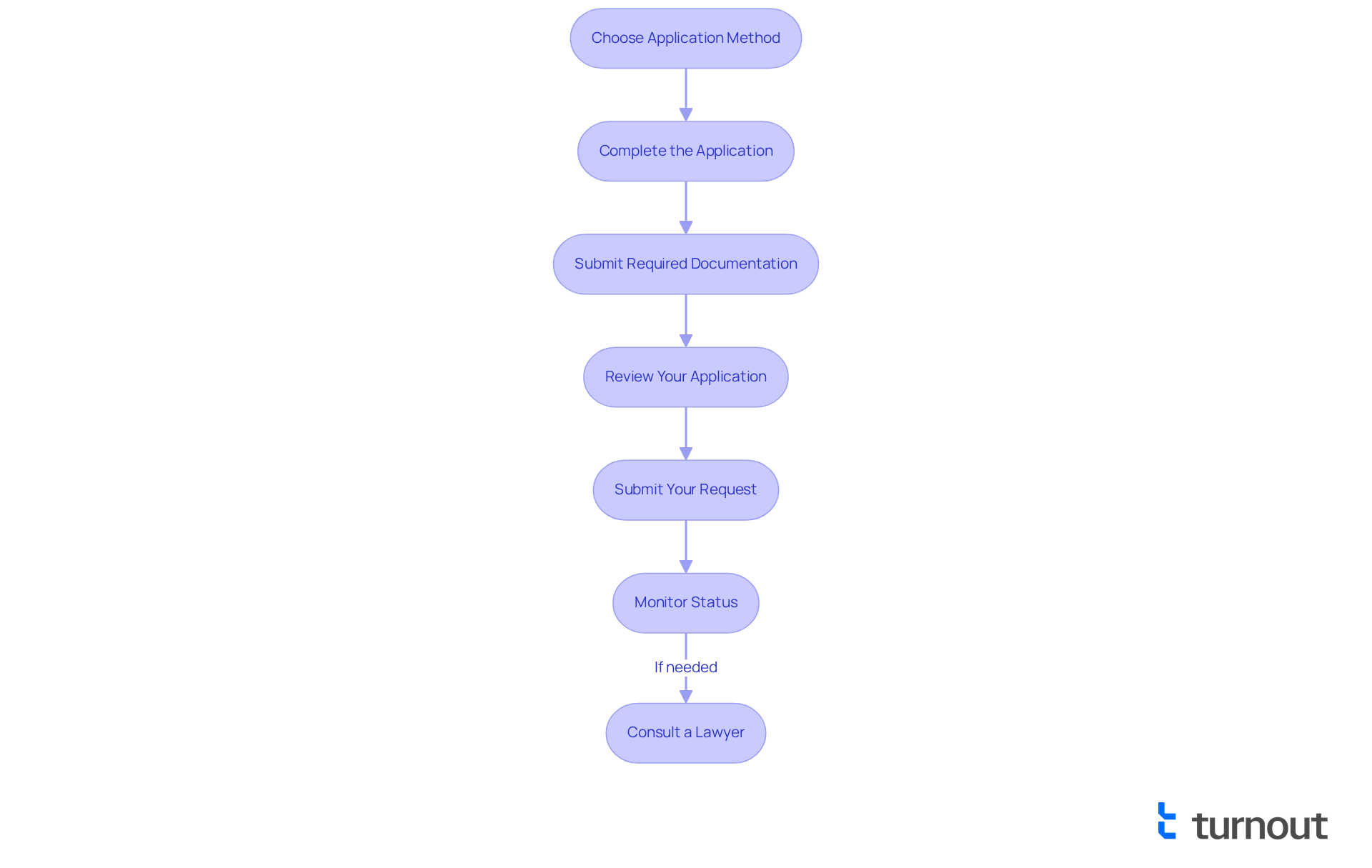

Navigating the social security insurance disability application process can feel overwhelming, but we're here to help. Follow these essential steps to make your journey smoother:

- Choose Your Application Method: You can apply online via the SSA website, by phone, or in person at your local Social Security office.

- Complete the Application: Provide precise information about your health status, work history, and personal details.

- Submit Required Documentation: Attach all necessary documents, including comprehensive medical records and a detailed work history.

- Review Your Application: Carefully double-check for accuracy and completeness to avoid delays.

- Submit Your Request: Follow the guidelines for your selected submission method to send your request.

After submission, it's important to monitor your status through your my Social Security account. Respond promptly to any requests for additional information from the SSA; this can prevent unnecessary delays.

In 2025, the average processing time for applications for social security insurance disability is approximately 3 to 6 months, but it's crucial to note that around 65% of initial claims are denied. This highlights the importance of ensuring your application is thorough. Many successful candidates emphasize the significance of detailed health documentation and prompt follow-ups. One applicant shared, 'Having all my medical records organized made a significant difference in my approval.'

Consider seeking assistance from a lawyer to help finalize and submit your request correctly. This can minimize the chance of mistakes that might lead to delays or refusals. By following these steps and being diligent, you can enhance your chances of receiving the benefits you deserve. If your request is denied, remember that you have 60 days to contest the decision. You are not alone in this journey, and support is available to help you through the process.

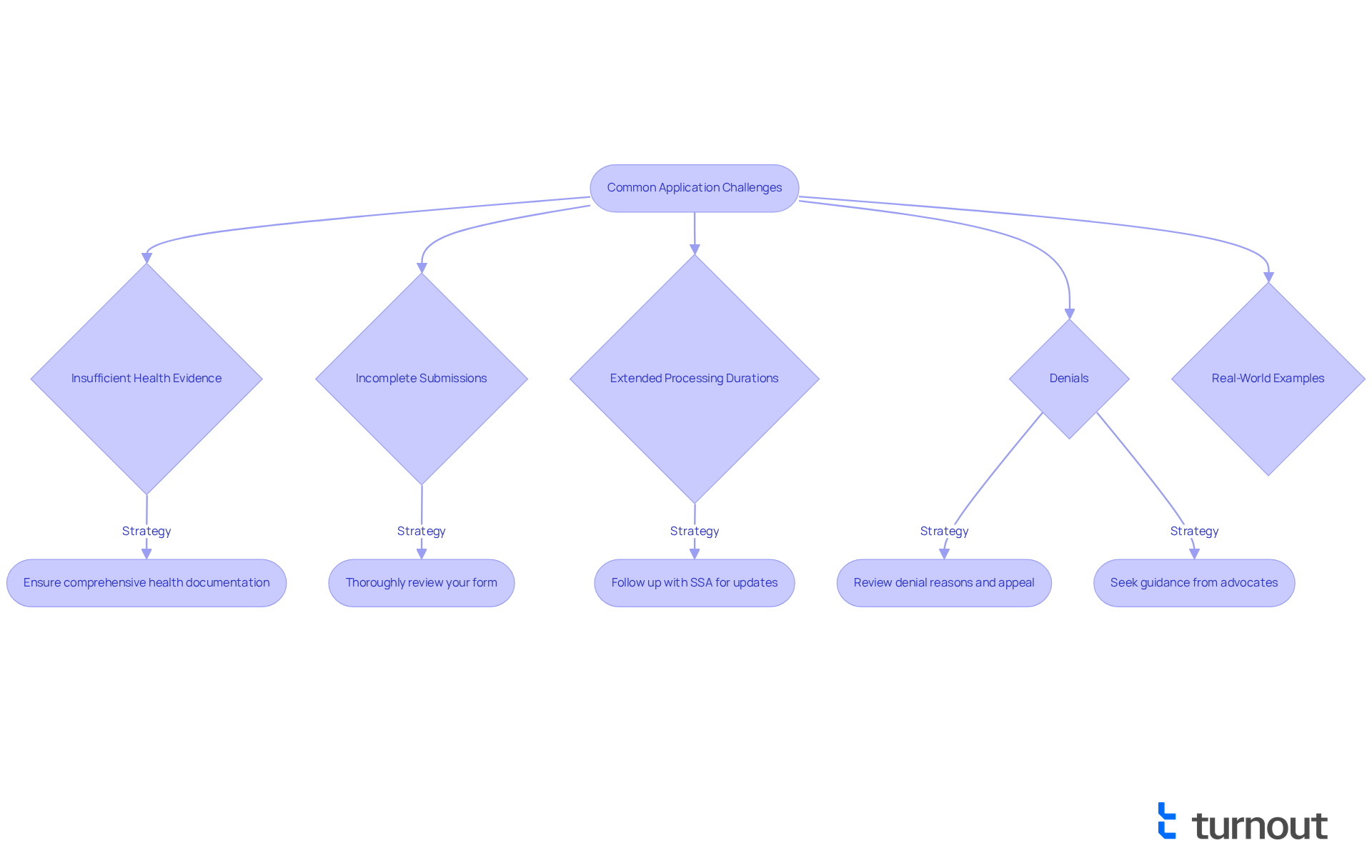

Troubleshoot Common Application Challenges

Navigating the social security insurance disability application process can indeed feel overwhelming. We understand that you may encounter several challenges along the way. Here are some common obstacles and supportive strategies to help you overcome them:

-

Insufficient Health Evidence: Comprehensive health documentation is crucial. It’s important to ensure your records detail your disability and its impact on your ability to work in relation to social security insurance disability. Incomplete or inaccurate medical records can lead to delays or denials, as the SSA requires clear evidence of your condition for social security insurance disability.

-

Incomplete Submissions: Take a moment to thoroughly review your form. Ensuring all sections are filled out completely and accurately is vital. Missing information can result in automatic denials, so double-checking your submission is essential.

-

Extended Processing Durations: It’s common to experience hold-ups in handling your request. If you haven't received updates within a reasonable timeframe, consider following up with the SSA to inquire about your request's status. Remember, you are not alone in this journey.

-

Denials: If your social security insurance disability request is denied, it’s important to carefully review the reasons provided. You have 60 days to file an appeal, and missing this deadline can forfeit your right to appeal. Seeking assistance from an advocate or legal professional can significantly improve your chances of success. Statistics show that appeal success rates can vary, but having the right support can truly make a difference.

-

Real-World Examples: Many individuals have successfully navigated these challenges. For instance, the Smith Family from Waco, TX, initially faced denial due to insufficient medical documentation. However, with the guidance of knowledgeable advocates, they gathered the necessary evidence and successfully appealed their case. Their experience highlights the importance of having support throughout the process.

By anticipating these challenges and preparing accordingly, you can enhance your chances of a successful SSDI application experience. Remember, we're here to help you every step of the way.

Conclusion

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming for those seeking financial support due to medical conditions. We understand that understanding the eligibility criteria, gathering necessary documentation, and following the application process are crucial steps that can significantly enhance your chances of approval. With millions relying on SSDI for financial stability, approaching this process with informed confidence is essential.

Key insights from this guide highlight the importance of a thorough understanding of SSDI eligibility requirements, such as:

- Work history

- Medical conditions

Comprehensive documentation is equally significant. It's common to face challenges during the application process, including:

- Insufficient health evidence

- Incomplete submissions

This underscores the need for careful preparation and follow-up. Remember, while initial claims may often be denied, a substantial number of appeals are successful. Persistence and support can make all the difference.

Ultimately, the journey to securing SSDI benefits may seem daunting, but it is navigable with the right resources and guidance. We encourage you to seek assistance from professionals and advocates who can provide valuable support throughout this process. By taking proactive steps and remaining informed, you can improve your chances of receiving the critical assistance you need. Remember, you are not alone in this journey; we are here to help.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a federal program that provides financial assistance to individuals who are unable to work due to a medical condition expected to last at least one year or result in death.

How many individuals receive SSDI benefits?

As of December 2023, over 8.7 million disabled beneficiaries received payments through SSDI.

What are the eligibility criteria for SSDI?

To qualify for SSDI, applicants must have an adequate work history, have contributed to Social Services taxes, and demonstrate that their condition significantly limits their ability to engage in substantial gainful activity.

What percentage of initial SSDI applicants are approved?

Only about 38% of initial applicants meet the technical criteria for acceptance. However, approximately 53% of those who appeal an initial denial are ultimately approved.

What types of medical conditions commonly lead to SSDI benefits?

Musculoskeletal system diseases account for 34.1% of diagnoses among disabled workers who often rely on SSDI benefits for financial stability.

What is the typical monthly assistance amount for SSDI beneficiaries?

The typical monthly assistance for disabled individuals receiving SSDI is around $1,483.10.

What are the work history requirements for SSDI eligibility?

Typically, applicants need to have earned 40 work credits, with at least 20 of those earned in the last 10 years. In 2025, a credit is earned for every $1,810 in covered earnings.

What defines a substantial gainful activity (SGA)?

Substantial gainful activity is defined as earning more than $1,550 per month for non-blind individuals and $2,590 for blind individuals.

How can applicants enhance their SSDI application process?

Consulting with an experienced disability attorney can enhance the application and assist in navigating the updated eligibility requirements.

Why is it important to review Social Security benefits earnings statements?

Examining your earnings statements is important to ensure you meet the updated work credit requirements for SSDI eligibility.