Overview

Managing payments with the IRS can feel overwhelming, but we're here to help you through it. This article outlines four essential steps to effectively manage your payments:

- Understanding your payment options

- Gathering the necessary documentation

- Establishing a payment plan

- Monitoring that plan

Each step is designed to support you with detailed explanations of available options, required documents, and strategies for maintaining compliance.

It's common to feel anxious about financial obligations, but proactive management is key to avoiding penalties and ensuring financial relief. By taking these steps, you can navigate this process with confidence. Remember, you are not alone in this journey; we understand the challenges you face, and we're here to guide you every step of the way.

Introduction

Navigating the complexities of tax obligations can often feel overwhelming. We understand that managing payments with the IRS is a significant concern for many. With a variety of payment options available, it's essential to grasp these structures to find the most suitable solution for your financial circumstances.

What if there was a clear, step-by-step approach that could simplify the payment process? This guide explores effective strategies for managing IRS payments, helping you avoid penalties and interest. Together, we can ensure you tackle your tax responsibilities with confidence and clarity.

Understand IRS Payment Structures and Options

Navigating tax obligations can be daunting, and the IRS offers various methods to help you manage payments with IRS effectively. Understanding these options is crucial for finding the right path for your situation. Let’s explore the primary structures available to you:

-

Full Payment: If you're able to pay your tax bill in full, this is the simplest option available. You can make a one-time transaction using methods such as Direct Pay, credit or debit cards, or checks.

-

Installment Agreements: For those who may struggle to pay their tax bill in full, setting up an installment agreement allows you to pay your balance over time. This can be arranged online, by phone, or via mail. It's worth noting that over 70% of taxpayers who cannot pay their dues each year opt for these agreements.

-

Short-Term Financing Options: If you expect to clear your balance within 180 days, a short-term financing option might be right for you. Typically, this incurs no setup fee and is ideal if you anticipate a quick resolution to your tax obligations.

-

Long-Term Installment Options: If your balance exceeds $50,000, you may qualify for a long-term installment plan. This allows for monthly contributions over an extended period, accommodating larger debts while offering manageable terms for settlement. Additionally, the Streamlined Installment Agreement (SLIA) permits a maximum duration of 72 months for assessed tax balances of $50,000 or less.

-

Guaranteed Installment Agreement (GIA): If your balance is $10,000 or less, the GIA provides a maximum term of 36 months. This simplifies the process without requiring extensive financial disclosures, making it more accessible.

-

Offer in Compromise: In certain situations, you may negotiate a settlement for less than what you owe by demonstrating financial hardship. This option can provide significant relief for those struggling to meet their tax obligations.

By familiarizing yourself with these options, you can select the most appropriate path based on your financial circumstances and ability to pay. Understanding these structures not only empowers you to manage your tax obligations effectively, including making payments with IRS, but also helps in avoiding potential penalties and interest that can accrue during delays. Remember, penalties and interest continue to accumulate during any delay of collection until the full amount is paid. If you owe more than $100,000, you must provide financial disclosure of your assets, income, and expenses to the IRS.

Moreover, the IRS's timeframe to collect is paused when a repayment arrangement or Offer in Compromise (OIC) request is under consideration, providing extra assistance during financial difficulties. You're not alone in this journey, and we're here to help you find the best solution.

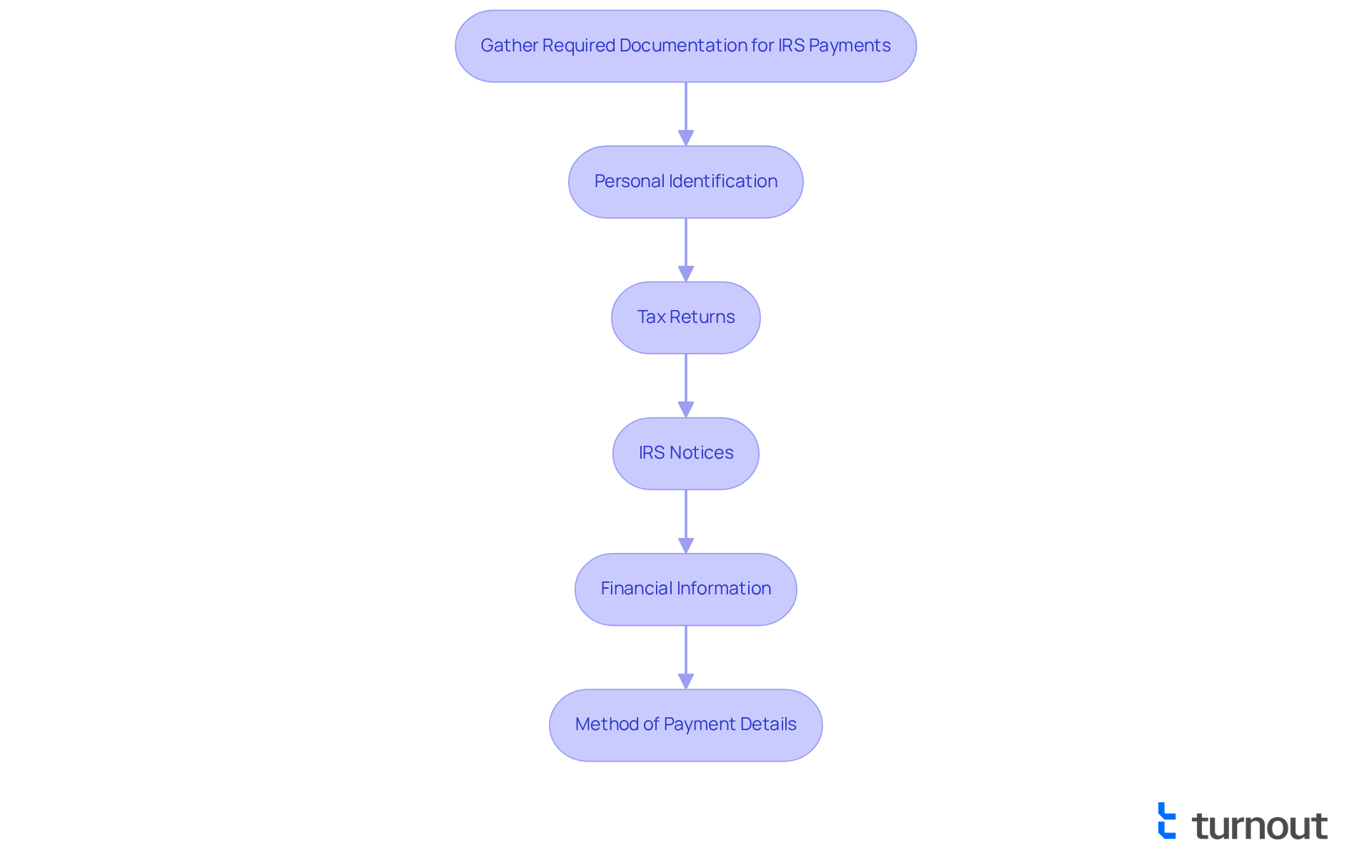

Gather Required Documentation for IRS Payments

Before you can establish a financial arrangement or make payments with IRS, it's essential to gather certain documentation. We understand that this process can feel overwhelming, but having everything in order will help you navigate it more easily. Here’s what you’ll typically need:

- Personal Identification: This includes your Social Security number (SSN) or Employer Identification Number (EIN), if applicable.

- Tax Returns: Have copies of your most recent tax returns available, as they provide important information about your income and tax liabilities.

- IRS Notices: Collect any notices or letters from the IRS regarding your tax balance or financial options.

- Financial Information: Prepare a summary of your financial situation, including income, expenses, and assets. This information may be necessary if you are applying for an Offer in Compromise.

- Method of Payment Details: If you plan to set up direct debit for your transactions, be ready with your bank account information. Keep in mind that direct debit is required for IRS arrangements with balances between $25,000 and $50,000.

It's important to remember that you can request an IRS arrangement on your own without needing to make payments with IRS to a third party. Furthermore, be cautious of scams; the IRS will never contact you through phone, text, or social media for prompt settlement.

Having these documents organized will simplify the process of establishing your financial arrangement and ensure that you can respond quickly to any inquiries regarding payments with IRS. For additional assistance with payments with IRS, consider using the online tools available on the IRS website, which can guide you in setting up your financial arrangement. Additionally, be aware that there may be setup charges for extended financing arrangements, which could impact your financial strategy.

You are not alone in this journey. We’re here to help you every step of the way.

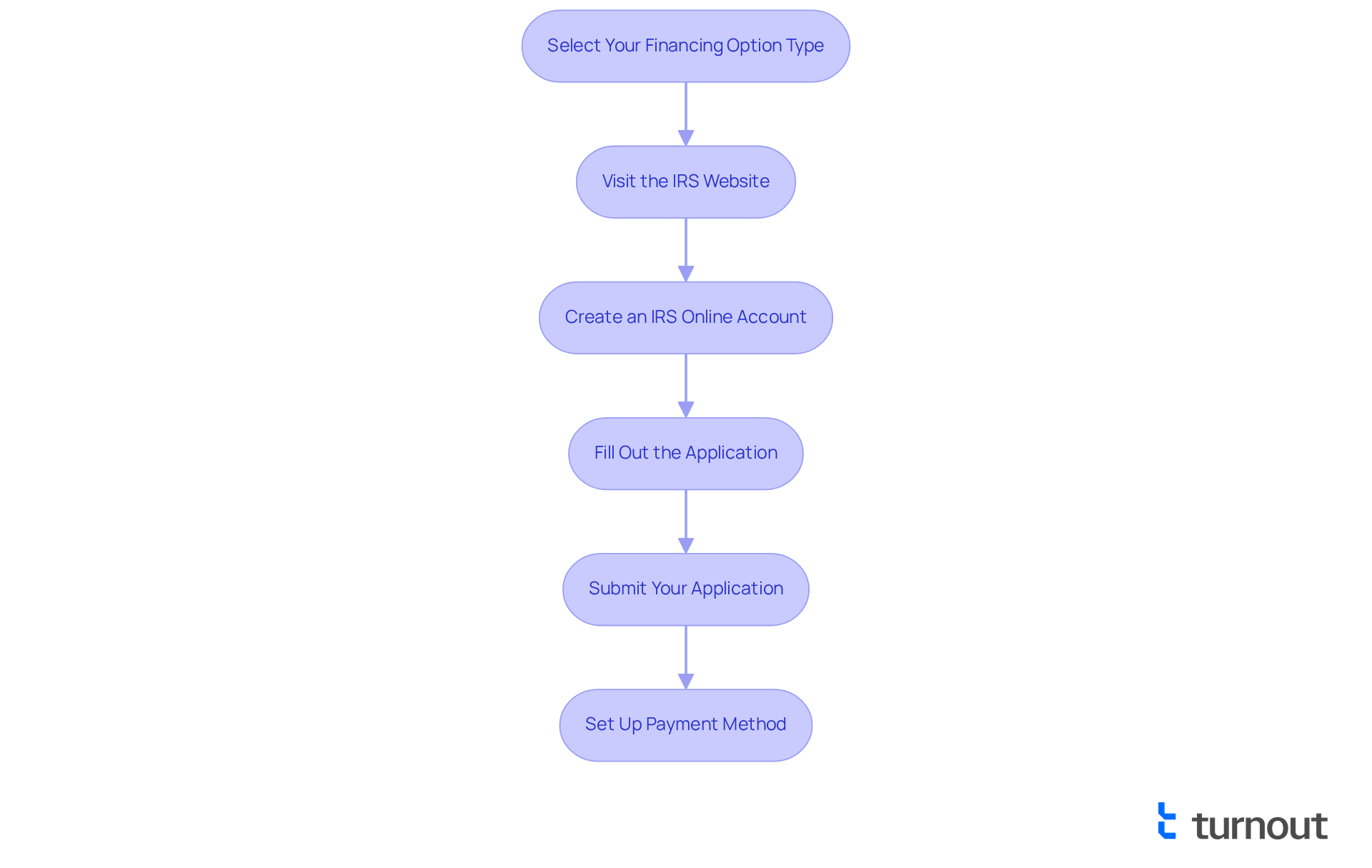

Establish a Payment Plan with the IRS

If you’re feeling overwhelmed by tax obligations, making payments with the IRS through a payment plan can be a helpful step forward. Here’s how to navigate this process with care:

-

Select Your Financing Option Type: Start by determining whether a short-term or long-term arrangement suits your financial situation best. If you can settle your balance within 180 days, a short-term option may be ideal. For those needing more time, long-term arrangements allow repayment over up to 72 months.

-

Visit the IRS Website: Head to the IRS website and find the Online Payment Agreement application. If you prefer, you can also apply by phone or mail, ensuring you choose the method that feels most comfortable for you.

-

Create an IRS Online Account: If you don’t have one yet, it’s a good idea to create an IRS Online Account. This will help you manage your financial arrangement and keep track of your account information easily.

-

Fill Out the Application: Take a moment to complete the application form. You’ll need to provide your personal information, tax details, and the type of financial plan you’re requesting. Don’t forget to include any required financial information.

-

Submit Your Application: After reviewing everything for accuracy, submit your application. If you’re applying online, you’ll receive immediate feedback on your application status, which can help simplify the process.

-

Set Up Payment Method: Choose how you’d like to make your payments—whether through direct debit, check, or electronic methods. Setting up direct debit can be particularly helpful as it automates your transactions, making things easier for you.

Once your application is approved, you will receive confirmation from the IRS detailing your financial arrangement. Enrolling in a financing plan can significantly reduce penalties and provide manageable monthly installments for payments with IRS, offering you much-needed relief as you deal with tax liabilities. These installment options allow you to spread your tax dues over time, which can greatly assist in managing your cash flow.

Additionally, keep in mind that the setup charge for extended financing options varies from $22 to $178, depending on how you apply. It’s wise to consider this when planning your fees. Remember, consulting with tax experts can also provide you with valuable negotiation strategies to help secure the best possible terms for your settlement agreement. You are not alone in this journey; we’re here to help you every step of the way.

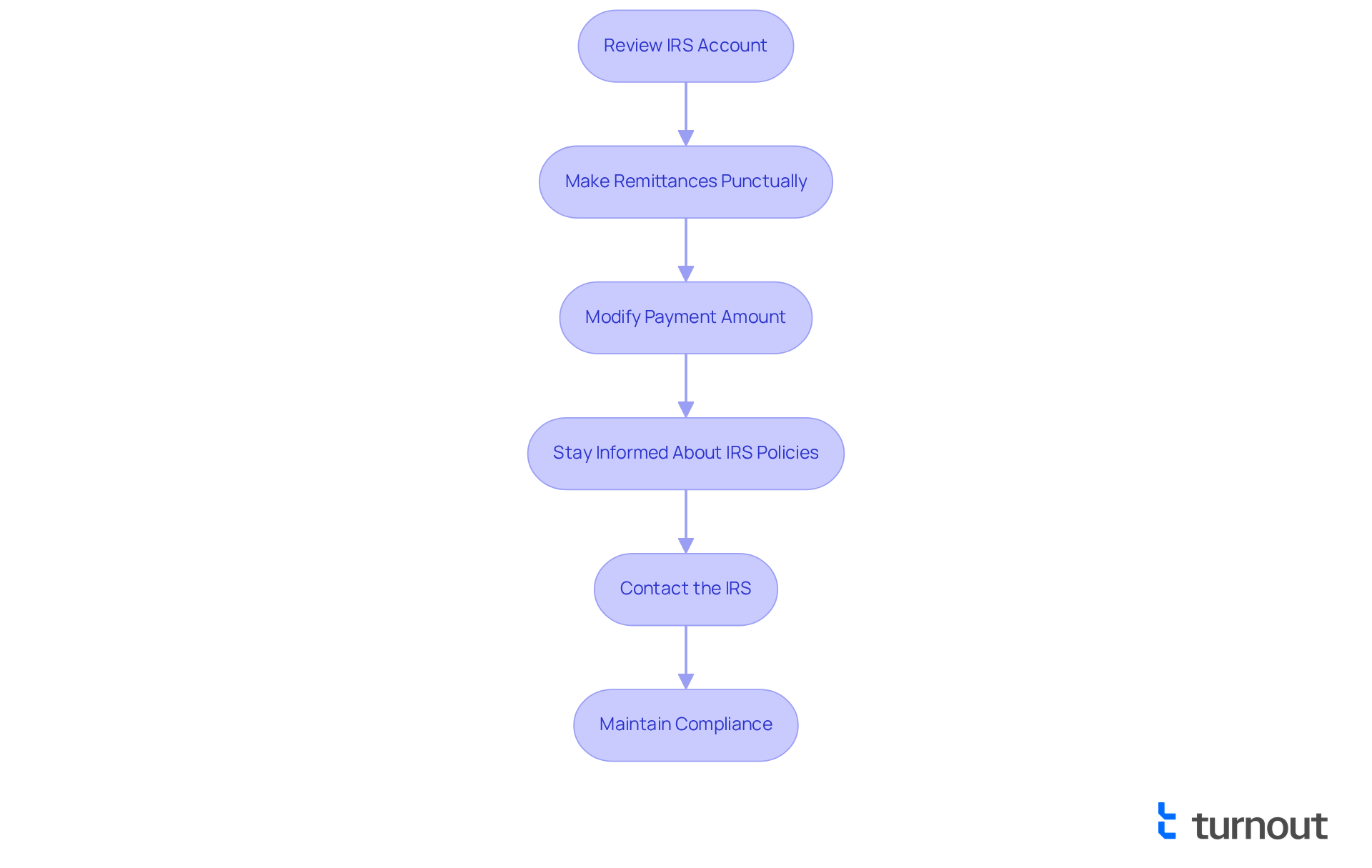

Monitor and Adjust Your IRS Payment Plan

After setting up your financial arrangement, we understand that monitoring and adjusting it as necessary is crucial. Here’s how you can effectively manage your IRS payment obligations:

- Consistently Review Your IRS Account: We encourage you to access your IRS Online Account to examine your transaction history, outstanding balance, and forthcoming dues. This proactive approach keeps you informed about your obligations and helps you avoid surprises.

- Make Remittances Punctually: It's important to make prompt remittances to prevent penalties or defaulting on your agreement. Consider establishing automatic transactions to ensure you never overlook a due date.

- Modify Your Amount if Necessary: If your financial circumstances change—such as a job loss or unforeseen costs—you may need to adjust your payment amount. This can be done through the Online Payment Agreement application or by contacting the IRS directly. In 2025, many taxpayers have successfully adjusted their strategies to better align with their current financial situations, particularly noting that the IRS traditionally enforces a 15% charge on disbursements from the federal government for tax obligations.

- Stay Informed About IRS Policies: Regularly updating yourself on any changes in IRS policies or financial options that could impact your plan is essential. New provisions may allow for more flexible financial arrangements, which can be beneficial. As Jessica Marine, Director at Frost Law, noted, staying informed about IRS changes is vital for effective tax management.

- Contact the IRS: If you encounter challenges in making payments, please reach out to the IRS without delay. They may offer alternatives to adjust your strategy or provide temporary relief, ensuring you remain compliant without undue stress. Turnout has successfully assisted individuals in navigating these complexities, demonstrating the importance of proactive communication.

By actively managing your payment plan, you can maintain compliance with IRS requirements related to payments with irs and avoid unnecessary complications. Remember, you are not alone in this journey; we’re here to help you achieve a more manageable tax obligation.

Conclusion

Understanding the various payment options available with the IRS is essential for managing tax obligations effectively. We recognize that navigating these responsibilities can feel overwhelming, but by familiarizing yourself with the payment structures, gathering the necessary documentation, establishing a payment plan, and monitoring that plan, you can approach your financial responsibilities with greater confidence and ease.

It's important to know the different payment methods available, such as:

- Full payment

- Installment agreements

- Offers in compromise

Gathering personal identification, tax returns, and financial information can streamline the process and alleviate some of the stress. Establishing a payment plan tailored to your unique circumstances and maintaining regular communication with the IRS can significantly reduce anxiety and help prevent penalties.

Ultimately, proactive management of IRS payments not only ensures compliance but also contributes to your financial stability. By taking charge of your tax obligations and utilizing the resources available, you can transform what may seem like a daunting task into a manageable process. Remember, empowerment through knowledge and action is crucial—seek assistance when needed, stay informed about IRS policies, and know that you are not alone in this journey. With the right tools and support, navigating your tax responsibilities can be effectively managed.

Frequently Asked Questions

What are the main payment options available for managing IRS tax obligations?

The main payment options include Full Payment, Installment Agreements, Short-Term Financing Options, Long-Term Installment Options, Guaranteed Installment Agreement (GIA), and Offer in Compromise.

What is the Full Payment option?

The Full Payment option allows you to pay your tax bill in full through a one-time transaction using methods such as Direct Pay, credit or debit cards, or checks.

How do Installment Agreements work?

Installment Agreements enable taxpayers who cannot pay their tax bill in full to pay their balance over time. This can be arranged online, by phone, or via mail, and over 70% of taxpayers who struggle with payments choose this option.

What are Short-Term Financing Options?

Short-Term Financing Options are suitable if you expect to pay your balance within 180 days and typically incur no setup fee, making them ideal for quick resolutions.

What are Long-Term Installment Options?

Long-Term Installment Options are available for balances exceeding $50,000, allowing for monthly payments over an extended period. The Streamlined Installment Agreement (SLIA) allows a maximum duration of 72 months for balances of $50,000 or less.

What is the Guaranteed Installment Agreement (GIA)?

The GIA is available for balances of $10,000 or less, providing a maximum term of 36 months without requiring extensive financial disclosures, making it more accessible.

What is an Offer in Compromise?

An Offer in Compromise allows you to negotiate a settlement for less than what you owe by demonstrating financial hardship, providing relief for those struggling with tax obligations.

What happens if I owe more than $100,000?

If you owe more than $100,000, you must provide financial disclosure of your assets, income, and expenses to the IRS.

How does the IRS handle collection during repayment arrangements or Offer in Compromise requests?

The IRS's timeframe to collect is paused when a repayment arrangement or Offer in Compromise request is under consideration, providing additional assistance during financial difficulties.

Why is it important to understand these payment options?

Understanding these payment options empowers you to manage your tax obligations effectively and helps avoid potential penalties and interest that can accrue during delays in payment.