Overview

Applying for Social Security Disability Insurance (SSDI) can feel overwhelming, but you are not alone in this journey. To successfully navigate this process, it’s important to follow a structured approach. Begin by:

- Understanding the eligibility requirements

- Gathering the necessary documentation

- Completing your application accurately

We understand that waiting for a decision can be stressful, but thorough preparation can make a significant difference.

Collecting detailed medical records and work history is essential. Remember, the more complete your application, the better your chances of approval. Incomplete applications often lead to delays or even denials, which can be discouraging. By taking the time to prepare, you can enhance your likelihood of a favorable outcome.

We’re here to help you every step of the way. Know that you have the support you need as you navigate this process. Together, we can work towards achieving the assistance you deserve.

Introduction

Navigating the complexities of Social Security Disability Insurance (SSDI) can feel overwhelming for many individuals facing long-term medical challenges. We understand that understanding the eligibility requirements and the application process is crucial for securing the financial support you need during these difficult times.

However, it's common for many applicants to encounter hurdles that can delay or derail their efforts. What steps can you take to ensure a successful application and avoid common pitfalls in this critical journey?

We're here to help you through this process.

Understand Social Security Disability Insurance (SSDI)

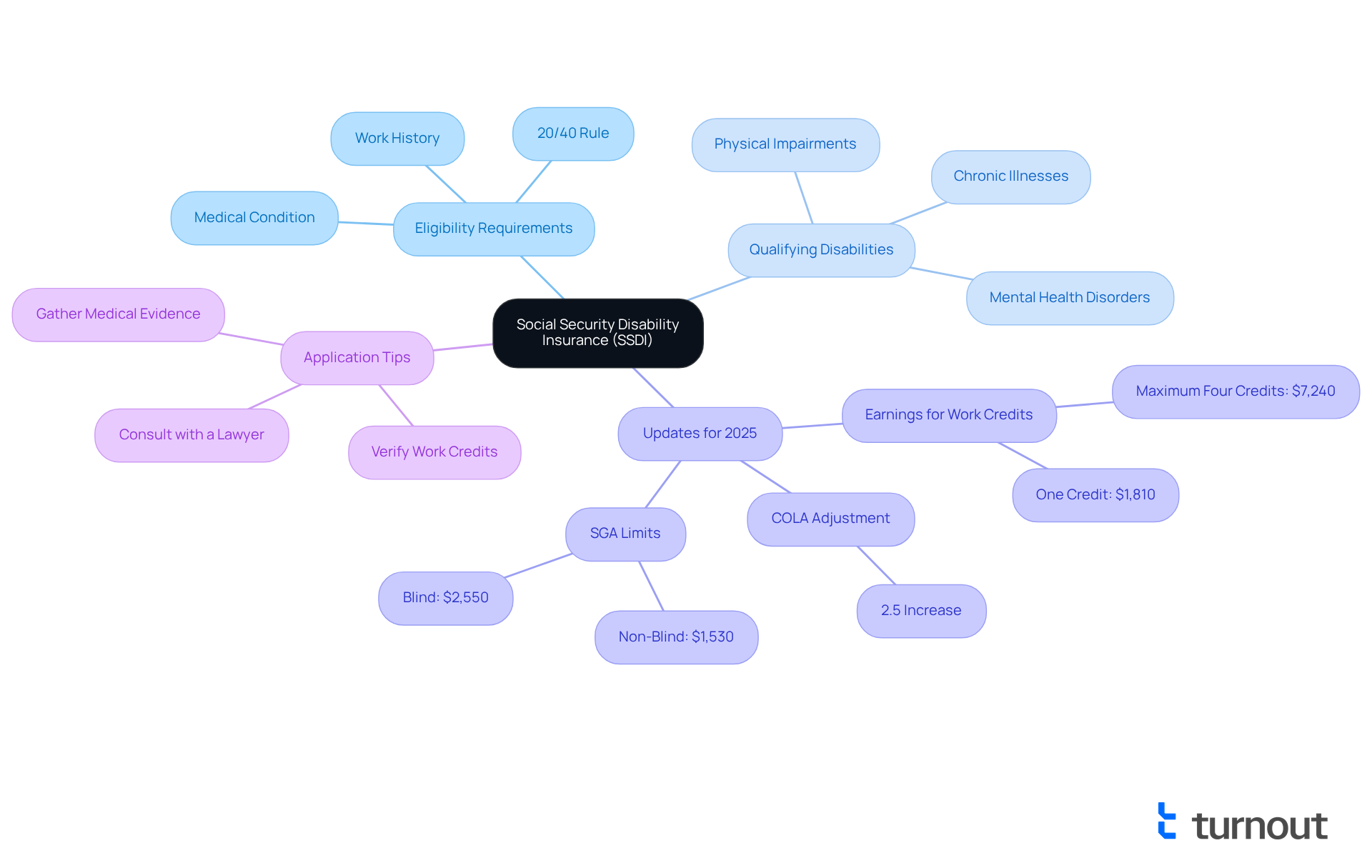

Disability Insurance (SSDI) is a vital federal program designed to offer financial support to individuals who cannot perform tasks due to a medical condition that is expected to last for at least one year or result in death. We understand that navigating this process can be overwhelming. To qualify, applicants need to show a solid employment history, having paid Social Security taxes, and meet specific eligibility criteria. A key requirement is the 20/40 rule, which states that applicants must have earned 20 work credits within the last 10 years. Understanding these qualifications is essential for applying for SSDI successfully.

The range of disabilities that may qualify for benefits includes various conditions, such as:

- Physical impairments

- Mental health disorders

- Chronic illnesses

Staying informed about the latest updates, including anticipated changes for 2025, is crucial for applicants. For instance, the Social Security Administration will adjust the earnings needed to earn employment credits, with one credit earned for every $1,810 in covered earnings, requiring at least $7,240 to achieve the maximum four credits. Additionally, the Substantial Gainful Activity (SGA) limits are expected to rise, allowing non-blind individuals to earn more without losing benefits.

Real-life examples highlight the importance of meeting these eligibility requirements. Many candidates find that understanding the nuances of the disability benefits program significantly enhances their chances of acceptance. Advocates emphasize that gathering comprehensive medical evidence and verifying work credits are essential steps in applying for SSDI. Furthermore, the 2.5% cost-of-living adjustment (COLA) for 2025 will provide crucial support to recipients amid rising living costs.

As advocates point out, being well-prepared and informed can greatly impact your experience when applying for SSDI. Remember, you're not alone in this journey. For comprehensive details, please refer to the Administration's disability benefits page. We’re here to help you every step of the way.

Gather Required Documentation and Information

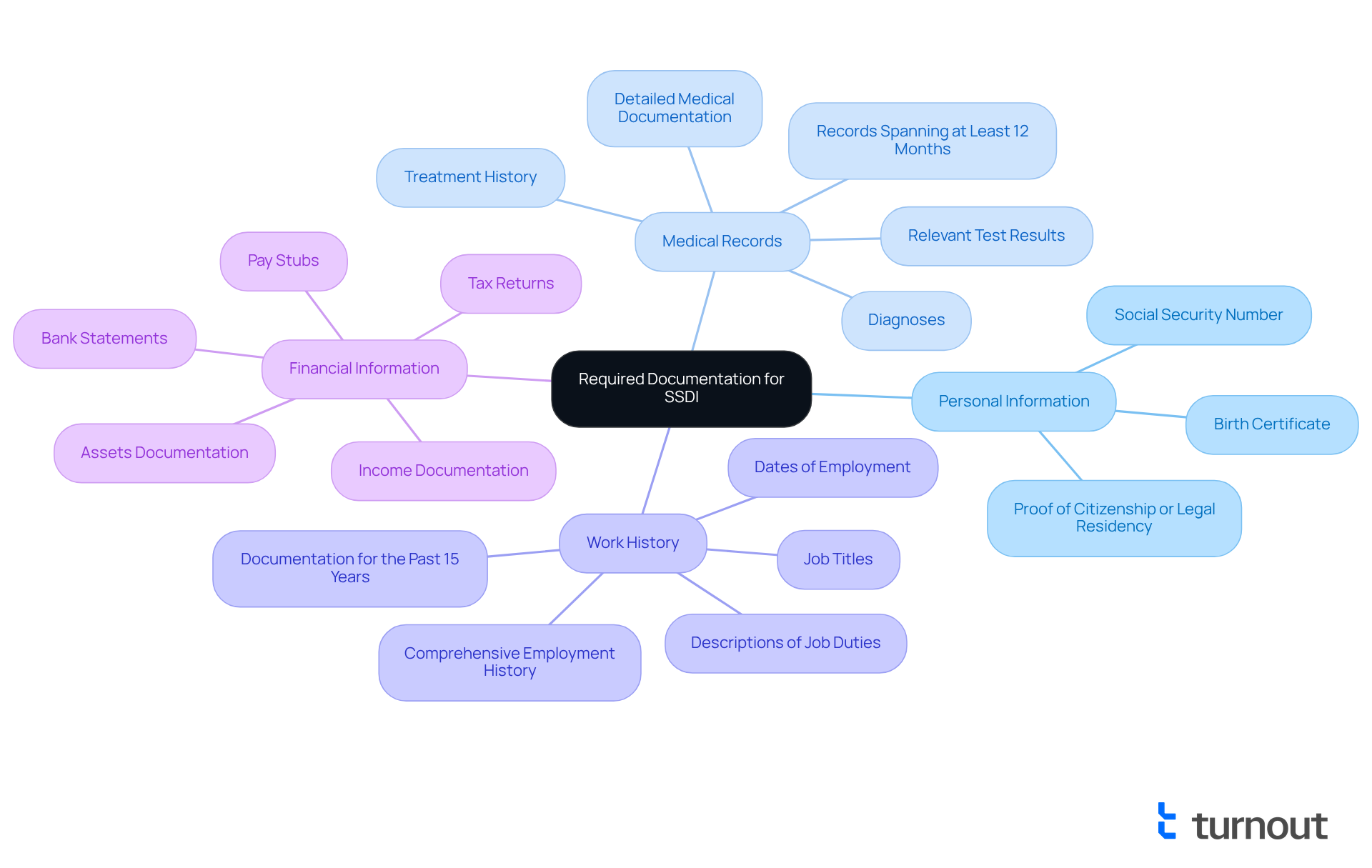

We understand that gathering the necessary documents can feel overwhelming before applying for SSDI. To help you navigate this process, it’s crucial to collect the following essential items:

- Personal Information: This includes your Social Security number, birth certificate, and proof of citizenship or legal residency.

- Medical Records: We encourage you to collect detailed medical documentation from your healthcare providers. This should encompass diagnoses, treatment history, and relevant test results. Ideally, your medical records should span at least 12 months. This demonstrates the persistence and severity of your disabling condition. Remember, incomplete records can significantly reduce your chances of approval and may lead to delays or denials.

- Work History: Prepare a comprehensive list of your employment history. Detail your job titles, dates of employment, and descriptions of your job duties. Complete documentation of your work history for the past 15 years is necessary to establish SSDI benefit eligibility.

- Financial Information: Document your income, assets, and any other benefits you receive. This may include tax returns, bank statements, and pay stubs.

Arranging these documents in a folder ensures easy access when completing your submission. Starting to gather proof immediately is a proactive step that can help avoid delays and improve your chances of approval. For a complete checklist, refer to the Adult Disability Starter Kit provided by the Social Security Administration. Remember, real-life examples show that applicants applying for SSDI who meticulously prepare their documentation often experience smoother application processes and higher approval rates. You are not alone in this journey; we’re here to help you every step of the way.

Complete and Submit Your SSDI Application

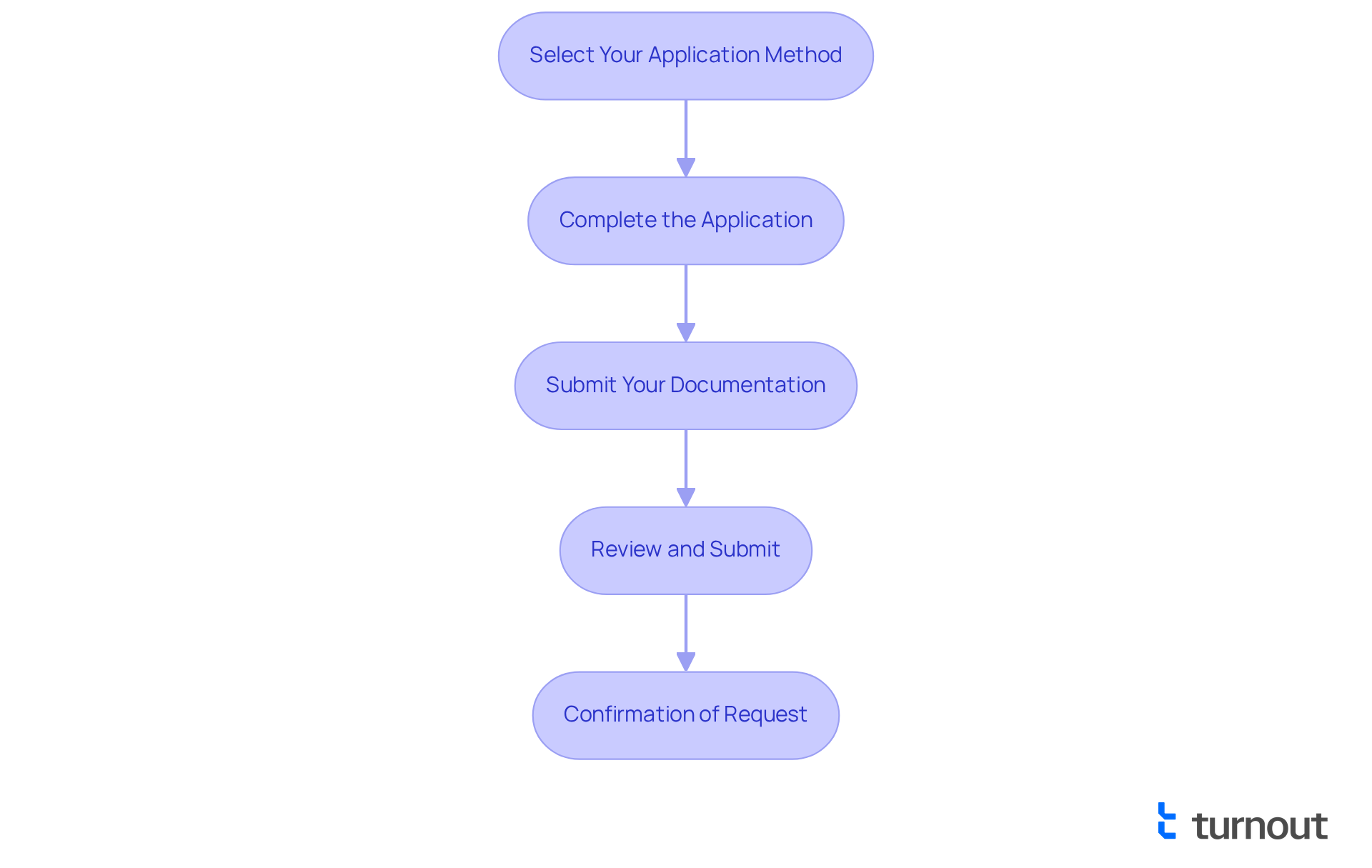

Applying for SSDI can feel overwhelming, but we are here to guide you through this crucial process. Follow these essential steps to make your application as smooth as possible:

-

Select Your Application Method: You have several options for submitting your application. You can do it online through the Social Security Administration (SSA) website, by phone at 1-800-772-1213, or in person at your local Social Security office. Many people prefer the online method for its convenience and efficiency, especially since the SSA is transitioning to an all-electronic benefits system by September 30, 2025.

-

Complete the Application: If you choose to apply online, start by creating a my Social Security account. Fill out the form (SSA-16) with accurate and thorough information. It's crucial to be honest about your medical condition and how it impacts your ability to perform daily tasks—this honesty is vital for the success of your application.

-

Submit Your Documentation: Attach all necessary documents, including your medical records and work history. Remember, thorough documentation is key; incomplete submissions can lead to significant delays in processing your request.

-

Review and Submit: Before you submit, take a moment to double-check your documents for accuracy and completeness. Once submitted, you will receive a confirmation of your request, which is important for tracking its progress.

Recent improvements to the online disability benefits request process have made applying for SSDI easier, significantly reducing the average processing time. As noted by the Disability Law Group, "Thorough preparation and understanding of the requirements can greatly enhance your chances of approval." For further support, consider reaching out to the Disability Law Group or similar organizations that can help you navigate common pitfalls and best practices in the disability benefits process. Additionally, staying informed about the SSA's updates to the list of impairments that may affect eligibility in 2025 is essential for applicants. Remember, you are not alone in this journey; help is available, and taking these steps can lead you closer to the support you need.

Navigate the Waiting Period and Understand the Decision Process

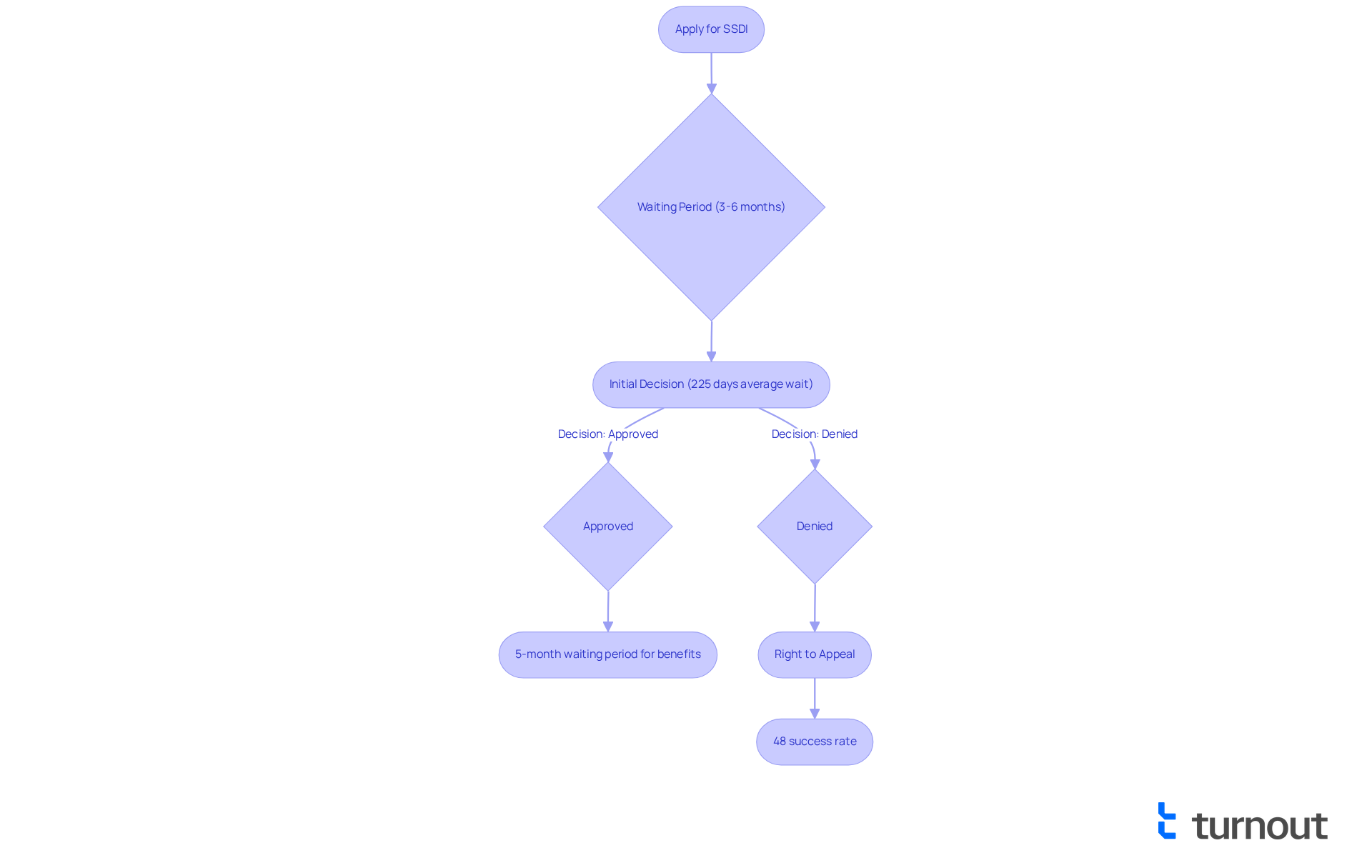

After applying for SSDI, we understand that you will enter a waiting period, which typically lasts between 3 to 6 months for an initial decision. During this time, it’s essential to stay informed and prepared.

-

Track Your Request: You can easily check the status of your request online through your my Social Security account or by calling the SSA. This proactive approach helps you feel more in control of your case.

-

Understand the Decision Process: The SSA follows a five-step approach to assess eligibility, which includes reviewing your employment history, medical condition, and ability to engage in alternative tasks. As of November 2023, the average wait time for an initial decision has reached approximately 225 days, reflecting an 86% increase from four months in November 2019. It’s common to feel anxious during this period, but knowing the process can provide some peace of mind.

-

Prepare for Possible Outcomes: If your application is approved, you will face a five-month waiting period before benefits begin. Conversely, if denied, remember that you have the right to appeal the decision. Familiarizing yourself with the appeals process is crucial when applying for SSDI, as nearly 60% of applicants face denial of benefits after waiting over seven months for an initial decision. The appeal process has a 48% success rate, which is important to consider as you navigate your options.

Advocates emphasize the importance of being prepared for the waiting period, as many applicants face financial hardships during this time. "People who are too sick or injured to work often face months without income while bills pile up," notes an advocate. By staying informed and understanding the decision-making process, you can better manage your expectations and plan your next steps.

For more information on the decision-making process, we encourage you to visit the SSA Approval Process page. Remember, you are not alone in this journey; we are here to help.

Conclusion

Successfully applying for Social Security Disability Insurance (SSDI) may feel overwhelming, but understanding the program's requirements and preparing your application can make a significant difference. We understand that this journey can seem daunting, yet with the right knowledge and preparation, you can greatly enhance your chances of approval. Recognizing the eligibility criteria, gathering necessary documentation, and navigating the application process are essential steps that lay a strong foundation for your claim.

Key insights from this guide highlight the importance of understanding SSDI qualifications, such as the 20/40 rule, and the necessity of compiling comprehensive medical and work history documentation. It's common to feel uncertain about the decision-making process and potential waiting periods, but being informed can help manage expectations and reduce anxiety. Real-life examples demonstrate that thorough preparation not only streamlines the application process but also improves the likelihood of receiving benefits.

Ultimately, applying for SSDI is a critical step for those unable to work due to disability. Embracing this process with diligence and awareness can lead to the financial support you need during challenging times. Remember, you are not alone in this journey; it is vital to stay informed about updates to the SSDI program and utilize available resources, such as the Social Security Administration's website and advocacy groups. Taking these proactive measures can empower you as you work toward securing the benefits you deserve.

Frequently Asked Questions

What is Social Security Disability Insurance (SSDI)?

SSDI is a federal program that provides financial support to individuals who are unable to work due to a medical condition that is expected to last at least one year or result in death.

What are the eligibility requirements for SSDI?

To qualify for SSDI, applicants must demonstrate a solid employment history, have paid Social Security taxes, and meet specific criteria, including the 20/40 rule, which requires earning 20 work credits within the last 10 years.

What types of disabilities may qualify for SSDI benefits?

Qualifying disabilities for SSDI benefits include physical impairments, mental health disorders, and chronic illnesses.

What is the 20/40 rule in relation to SSDI?

The 20/40 rule states that applicants must have earned 20 work credits within the last 10 years to qualify for SSDI.

How will the SSDI program change in 2025?

In 2025, the Social Security Administration will adjust the earnings needed to earn work credits, with one credit earned for every $1,810 in covered earnings, requiring at least $7,240 for the maximum four credits. Additionally, the Substantial Gainful Activity (SGA) limits are expected to rise.

What is the Substantial Gainful Activity (SGA) limit?

The SGA limit is the maximum amount a non-blind individual can earn without losing SSDI benefits; this limit is expected to increase in 2025.

Why is gathering medical evidence important for SSDI applications?

Comprehensive medical evidence is crucial for demonstrating the severity of the disability and enhancing the chances of acceptance for SSDI benefits.

What is the cost-of-living adjustment (COLA) for 2025?

The cost-of-living adjustment (COLA) for 2025 is set at 2.5%, which will provide additional support to SSDI recipients amid rising living costs.

Where can I find more information about SSDI?

For comprehensive details about SSDI and the application process, you can refer to the Social Security Administration's disability benefits page.