Overview

This article is here to support you in your journey through tax difficulties. We understand that managing tax debts can be overwhelming, and we want to help. That’s why we’ve compiled a list of ten tax relief companies that specialize in assisting individuals like you.

These companies offer innovative services designed to lighten your burden. From AI-powered solutions that streamline the process to personalized tax strategies tailored to your unique situation, they aim to empower you. Additionally, educational resources are available to help you better understand your tax obligations.

You are not alone in this journey. It’s common to feel anxious about tax debts, but these companies are equipped to simplify the process and provide the support you need. By exploring their services, you can find relief and regain control over your financial situation.

Take the first step towards a brighter financial future. Reach out to one of these companies and discover how they can assist you in managing your tax responsibilities. Remember, we’re here to help you navigate this challenging time with compassion and understanding.

Introduction

Navigating the labyrinth of tax obligations can often feel overwhelming, especially for those already carrying the weight of debt. We understand that this can be a daunting journey. Fortunately, specialized tax relief companies have emerged as a beacon of hope for individuals seeking financial reprieve. This article will explore ten standout companies that simplify the tax resolution process and empower you to take control of your financial future.

As you grapple with the complexities of IRS regulations and the possibility of audits, you may wonder: which tax relief company can provide the most effective support tailored to your unique financial situation? You are not alone in this journey, and we are here to help you find the assistance you need.

Turnout: AI-Powered Tax Debt Relief Advocacy

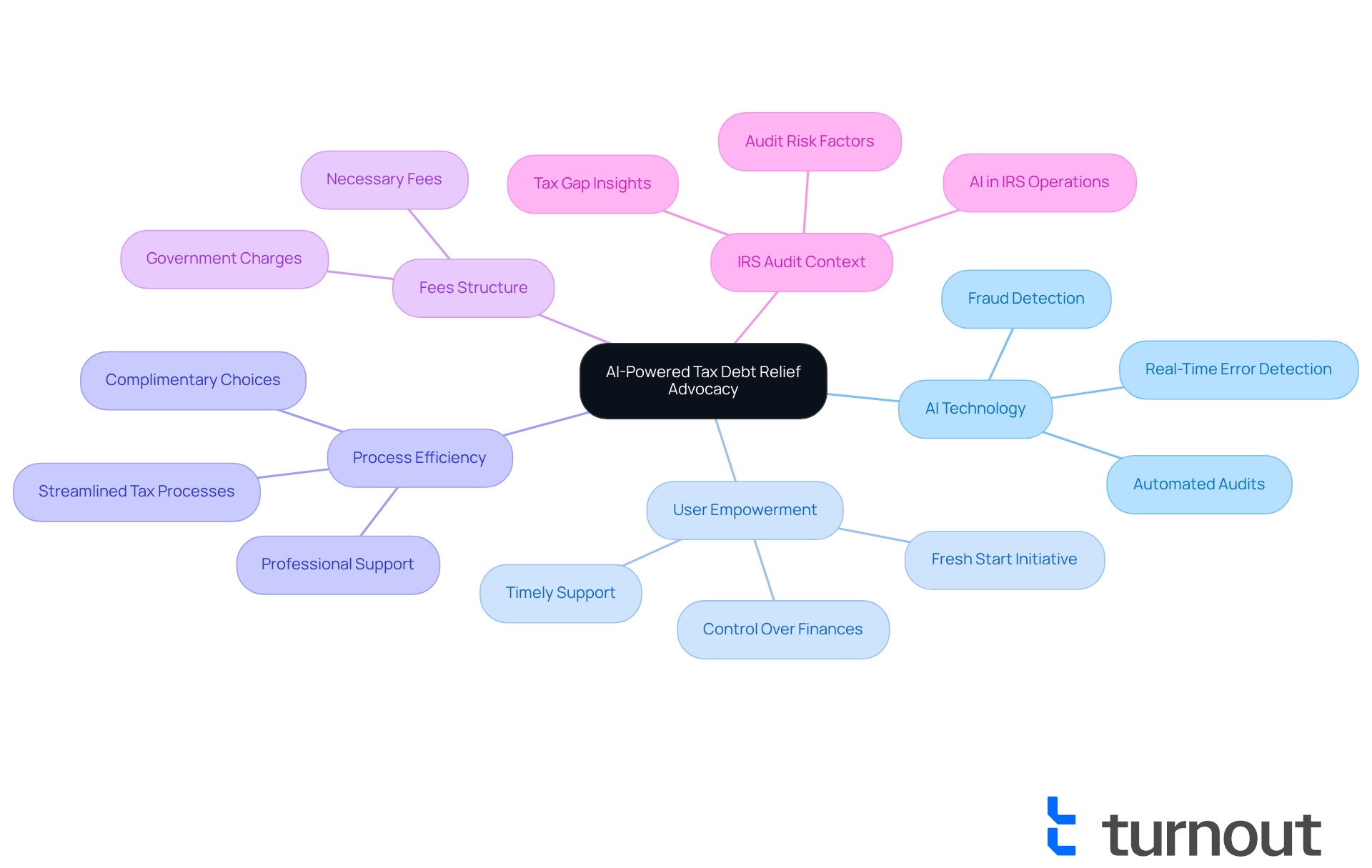

Turnout is revolutionizing the services provided by tax relief companies with its AI-powered platform, which is designed to help you navigate the complexities of tax obligations and government benefits. We understand that dealing with tax issues can be overwhelming, and that’s why Turnout utilizes advanced technology to streamline the process. This ensures that you receive timely support and guidance, making your journey a little easier.

This innovative approach not only enhances efficiency but also fosters a sense of empowerment among users like you, allowing you to take control of your financial situation with confidence. It’s common to feel uncertain about your options, but Turnout’s offerings include both complimentary choices and necessary fees, with governmental charges being distinct and required before any documentation is submitted on your behalf.

As the IRS intensifies its use of AI in audits—currently working on 68 AI-related projects aimed at modernizing operations—the role of technology in consumer advocacy becomes increasingly crucial. Experts note that tax relief companies can provide professional support to reduce audit risk and enhance your ability to dispute IRS findings, particularly with programs like the Fresh Start Initiative.

Turnout's dedication to incorporating AI into its advocacy efforts exemplifies a progressive approach that emphasizes your empowerment and the efficient resolution of tax problems. You are not alone in this journey, especially as taxpayers often encounter difficulties understanding IRS notifications and responding swiftly to audit correspondence. Remember, we're here to help you every step of the way.

Precision Tax Relief: Comprehensive Tax Resolution Services

At Turnout, we understand that navigating complex financial and governmental systems can be overwhelming. We're here to help you find your way. Specializing in tax relief companies and Social Security Disability (SSD) claims, our dedicated team is committed to supporting you through this journey.

Our group of trained non-legal advocates and IRS-licensed enrolled agents work closely with you to create tailored strategies for addressing tax debts and managing SSD claims. We prioritize transparency and communication, ensuring you feel supported every step of the way.

While we are not a law firm and do not provide legal representation, our qualified professionals are passionate about helping you achieve your financial objectives. You are not alone in this journey; our commitment to customer support and accessibility makes Turnout a dependable option for those seeking assistance with government benefits and financial relief through tax relief companies.

Take the first step towards a brighter financial future—reach out to us today.

Tax Defense Network: Tailored Tax Relief Solutions

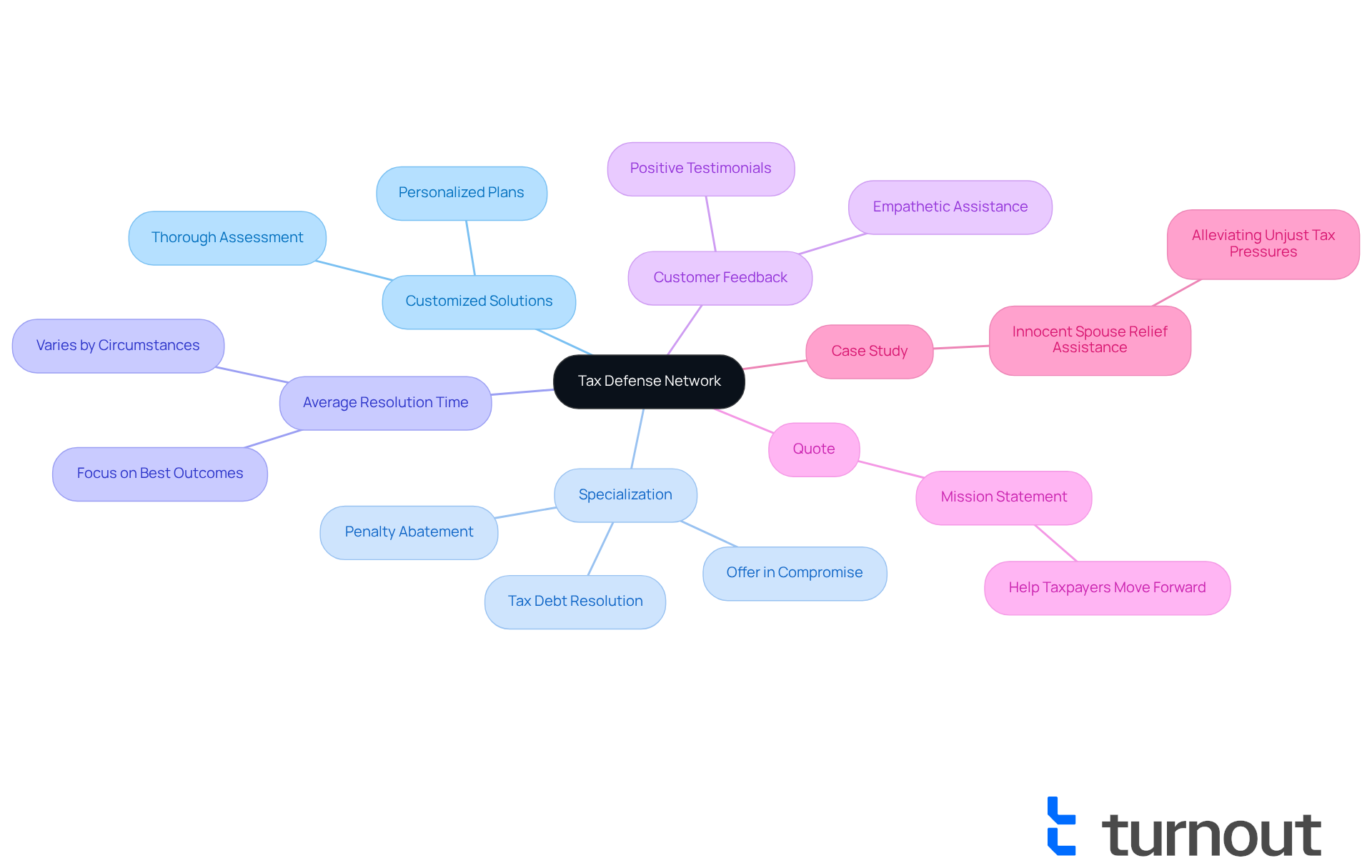

At Tax Defense Network, we understand that navigating tax obligations can be overwhelming. That's why we are committed to providing customized solutions through tax relief companies that address your unique requirements. Our approach begins with a thorough assessment of your individual tax situation, allowing us to create personalized plans that tackle your specific challenges. By focusing on tailored assistance, we ensure that you receive the support you need to manage your tax obligations efficiently, fostering a sense of trust and dependability.

- Specialization: Our firm specializes in tax debt resolution, offer in compromise, and penalty abatement. This comprehensive support is designed for individuals facing various tax challenges, ensuring you have the resources necessary to find relief with the help of tax relief companies.

- Average Resolution Time: While the average resolution time varies based on your specific circumstances, our focus remains on achieving the best possible outcomes through strategic, individualized support.

- Customer Feedback: Feedback from our pleased customers highlights the effectiveness of our customized solutions, reinforcing our reputation for providing empathetic and effective assistance.

- Quote: As one of our representatives stated, "Our mission is simple: help taxpayers move forward." This emphasizes our dedication to your success.

- Case Study: For instance, our Innocent Spouse Relief Assistance program has effectively supported individuals in alleviating unjust tax pressures, showcasing the tangible benefits of our services.

We’re here to help you on this journey. Remember, you are not alone in facing these challenges.

Instant Tax Solutions: Versatile Tax Relief Services

At Instant Tax Solutions, we understand that navigating tax issues can be overwhelming. That's why we offer an extensive range of tax relief companies tailored to meet your unique needs. Our approach encompasses everything from tax negotiation to settlement alternatives, ensuring you can select the options that best fit your financial situation. This flexibility is essential for those seeking immediate assistance, as it allows for personalized solutions that can significantly reduce stress and confusion.

Many of our customers have shared their success stories, highlighting the effectiveness of our services. For instance, one individual was able to lower their tax obligation dramatically, settling for just a fraction of what they owed, thanks to the strategic negotiation efforts of our dedicated team. In fact, one person managed to reduce their tax obligations by over $200,000, showcasing the profound impact we can have. These stories are common, as countless individuals report feeling empowered and relieved after working with us.

Consumer preferences are shifting towards more flexible negotiation and settlement options, reflecting a growing demand for personalized solutions provided by tax relief companies in the sector. Tax experts emphasize that understanding negotiation techniques can lead to better outcomes. At Instant Tax Solutions, we embody this philosophy by providing a variety of options tailored to your personal requirements. We strive to be an essential resource for anyone navigating the complexities of tax obligations in 2025. Remember, you are not alone in this journey; we are here to help.

Enterprise Consultants Group: Expert Tax Planning Services

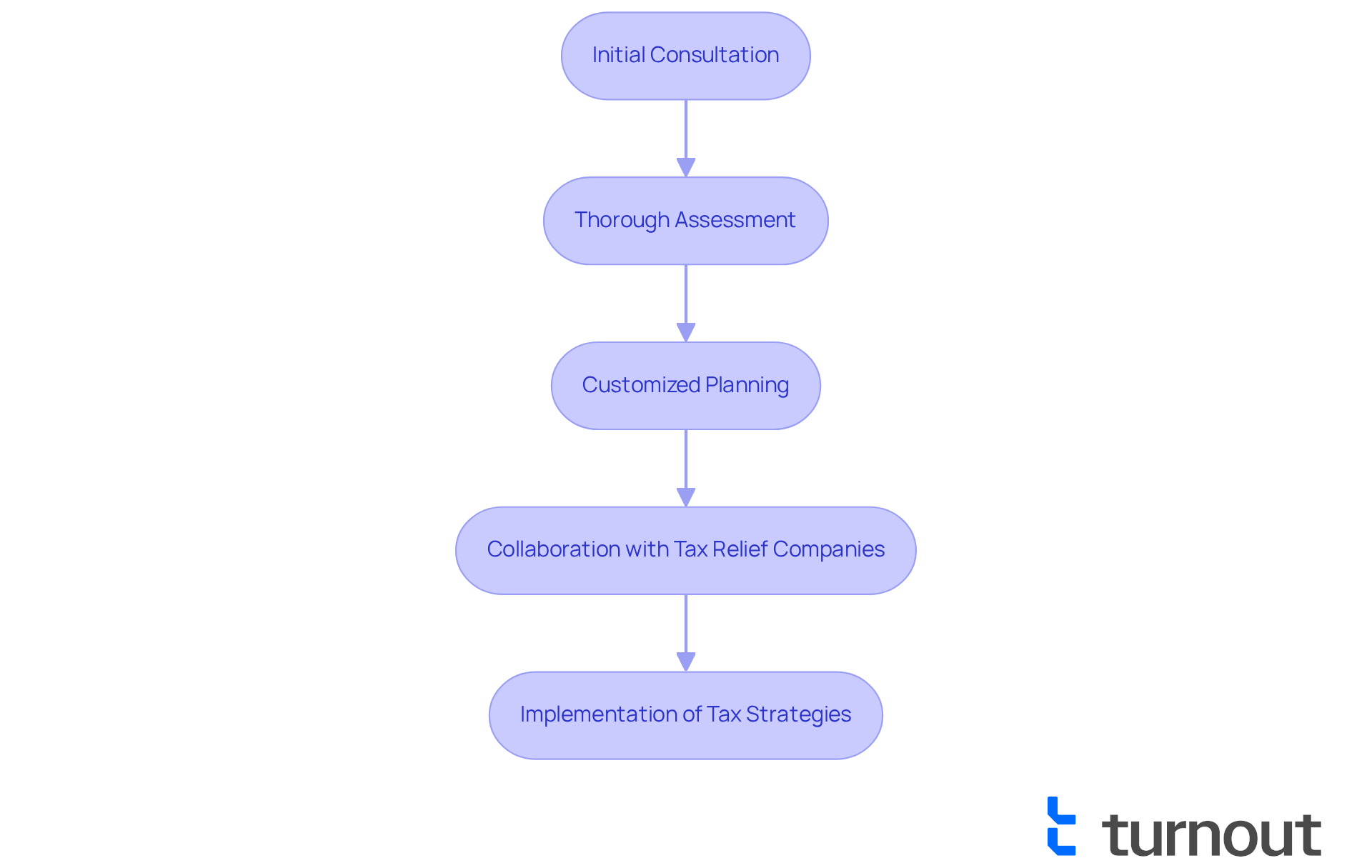

At Enterprise Consultants Group, we understand that managing tax responsibilities can be overwhelming, which is why we recommend consulting with tax relief companies. Our focus is on providing expert solutions through tax relief companies that are tailored to your unique needs, ensuring accuracy and peace of mind. Through thorough assessments and customized planning, we empower you to make informed decisions that effectively minimize your tax liabilities, often in collaboration with tax relief companies.

Our profound knowledge of tax regulations, combined with creative planning approaches, equips you to navigate upcoming tax obligations with the help of tax relief companies. This preparation greatly reduces the likelihood of facing unexpected tax burdens, making it easier to work with tax relief companies. Success stories from our clients highlight the impact of our services. For instance, one individual in the horse racing sector successfully reduced a tax obligation of over $250,000 to around $30,000, enabling them to obtain a required gaming license. This illustrates how strategic tax planning can lead to substantial savings and improved financial outcomes.

As our tax planners emphasize, the importance of proactive tax planning in working with tax relief companies cannot be overstated. It lays the groundwork for long-term financial health and compliance. Remember, you are not alone in this journey; we are here to help you navigate the complexities of tax planning with compassion and expertise.

ALG Tax Solutions: Educational Resources for Tax Relief

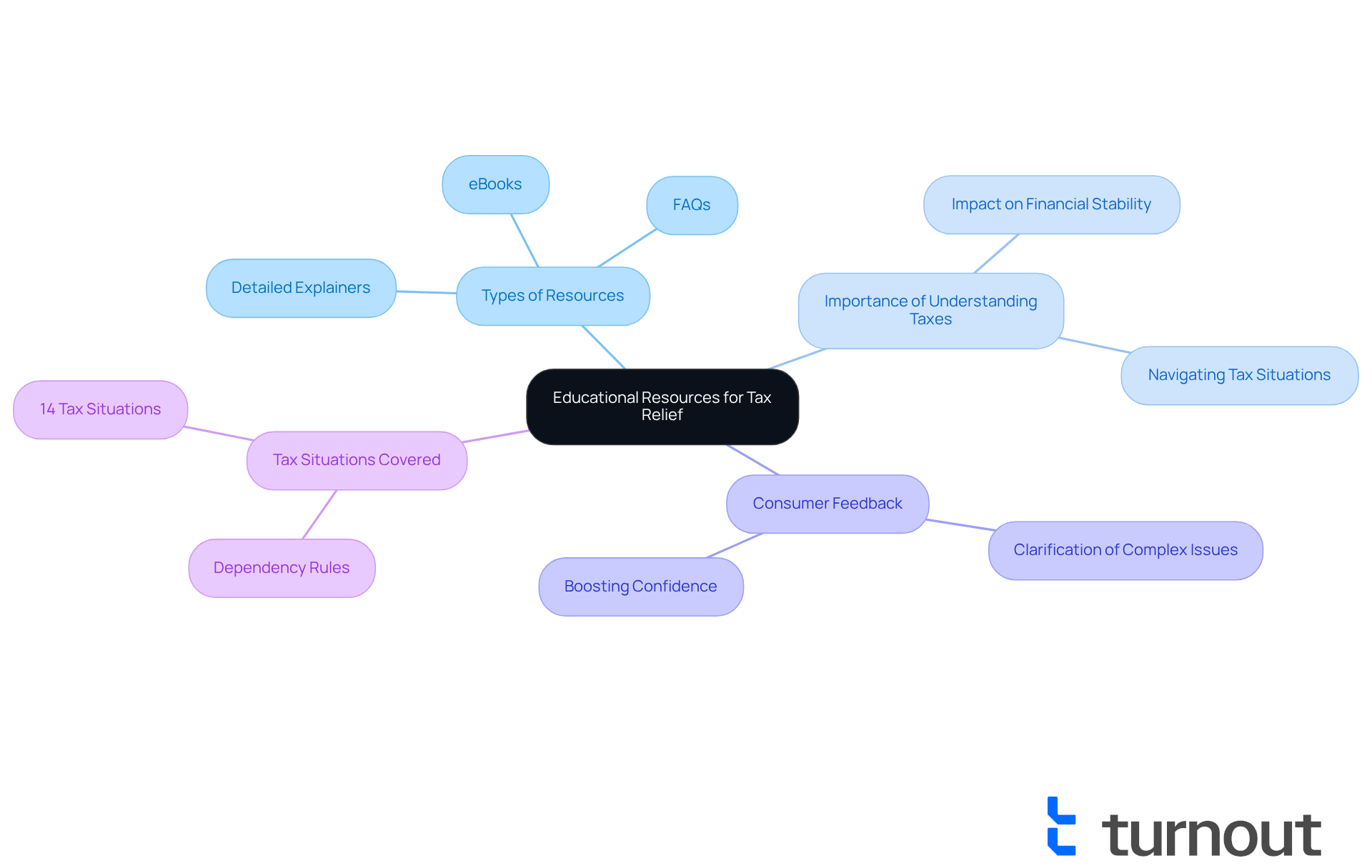

At ALG Tax Solutions, we truly understand the challenges you face when seeking assistance from tax relief companies. That’s why we offer a wide range of educational resources alongside our tax relief companies. Our website features a comprehensive library of free materials, including eBooks and FAQs, designed to simplify tax processes and relief options for you. By emphasizing education, we empower you with the knowledge needed to navigate your tax situation confidently, fostering a proactive approach to tax management.

In 2025, this focus on education is more important than ever. Understanding your tax obligations can significantly impact your financial stability. Consumer feedback reveals that our resources not only clarify complex tax issues but also boost your confidence in managing your responsibilities. As tax educators often say, informed consumers like you are better equipped to make decisions leading to favorable outcomes in your financial dealings.

Furthermore, we proudly cover all 14 tax situations surveyed, showcasing the depth of our educational offerings. Remember, you are not alone in this journey; we’re here to help you every step of the way.

Community Tax: Mobile-Friendly Tax Relief Solutions

We understand that navigating tax challenges can be overwhelming. Turnout offers mobile-friendly solutions from tax relief companies designed with the modern consumer in mind. Our user-friendly platform empowers you to access resources, oversee your cases, and connect with trained non-professional advocates and IRS-licensed enrolled agents easily.

By leveraging technology, we ensure that assistance is always within reach, allowing you to manage your tax challenges on the go. This approach enhances accessibility and aligns with the growing preference for mobile solutions in tax relief companies. It’s easier than ever to navigate your financial obligations.

Did you know that 88% of mobile time is devoted to applications? This highlights the importance of mobile solutions in tax assistance. Turnout also guides you through SSD claims and the services of tax relief companies, ensuring you receive expert guidance without needing legal representation.

Your satisfaction is our priority. We deliver quality assistance to reassure you as you seek financial support. With a focus on cost-effectiveness, we make our offerings available to individuals from diverse financial backgrounds. Remember, you are not alone in this journey; we're here to help you every step of the way.

TaxAudit.com: Insights and Support for Tax Audits

At TaxAudit.com, we understand that facing a tax audit can be a daunting experience. Our team of experts is dedicated to providing essential insights and support, ensuring you feel completely prepared to handle any IRS inquiries. By prioritizing education and proactive assistance, we empower you to navigate the complexities of audits, significantly reducing stress and uncertainty throughout the process.

With the IRS intensifying its focus on compliance—especially for those claiming the Earned Income Tax Credit (EITC)—it’s crucial to understand the audit landscape. Recent data shows that about 80% of audited EITC returns had issues related to child eligibility or income misreporting. This underscores the importance of meticulous preparation.

We don’t just help you prepare for inquiries; we also share success stories that highlight the effectiveness of our services. Individuals have reported an average decrease in audit-related stress and improved outcomes through our customized support. For instance, many have expressed how our assistance has made a significant difference in their experience.

To begin preparing for an audit, we recommend consulting with a tax advisor. This step allows you to review your filings and ensure all documentation is accurate and complete. Remember, you are not alone in this journey—we're here to help you every step of the way.

Hoyes Michalos: Debt Relief and Tax Solutions

At Turnout, we understand that financial challenges can feel overwhelming. That's why we adopt a holistic approach, providing relief from financial obligations alongside the assistance of tax relief companies. Our dedicated team, composed of skilled nonlawyer representatives and IRS-licensed enrolled agents, works closely with you to create personalized plans that address your tax liabilities and other financial responsibilities.

Importantly, we want you to know that Turnout is not a law firm and does not provide legal advice. This clarity ensures you understand the nature of the support we offer. Our integrated support empowers you to regain control over your finances, enhancing your chances of achieving a more stable financial future.

With the average tax obligation for individuals rising by 3.9% to $21,280 in 2024, the demand for comprehensive services like ours is more essential than ever. Many clients have reported significant improvements in their financial situations, showcasing the effectiveness of combining financial management with the strategies provided by tax relief companies. Addressing both taxes and liabilities simultaneously is crucial for your long-term financial health, especially in a landscape where tax relief companies can help manage rising costs and economic pressures.

If you’re facing similar challenges, remember, you are not alone in this journey. Consider reaching out to Turnout for tailored support, including assistance with Social Security Disability claims. We're here to help you navigate these tough times.

IRS: Direct Assistance for Tax Debt Relief

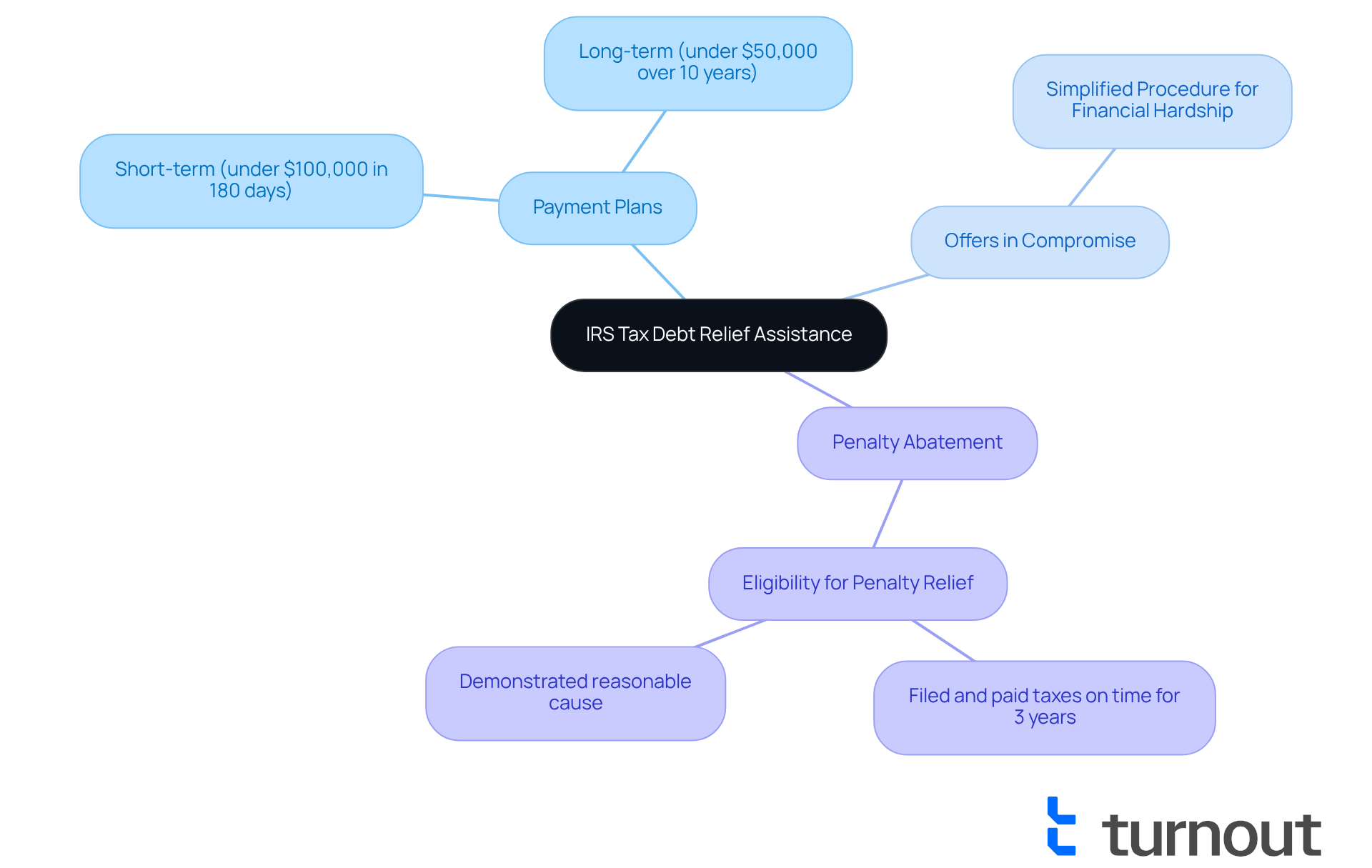

The IRS plays a crucial role in offering direct support for tax relief companies through various programs, such as payment plans and offers in compromise. These initiatives are specifically designed to help you manage your obligations effectively. For instance, short-term payment plans allow individuals to pay off balances under $100,000 within 180 days, while long-term plans enable monthly payments for balances under $50,000 over a period of up to 10 years.

We understand that navigating tax obligations can be overwhelming. Engaging directly with the IRS can lead to tailored solutions that fit your individual circumstances. If you have filed and paid your taxes on time for the past three years, you may qualify for penalty abatement, which can significantly reduce your overall tax burden.

Success rates for IRS payment plans and offers in compromise are promising. Many taxpayers report positive outcomes after utilizing these resources. For instance, the IRS's simplified offer in compromise procedure enables eligible individuals to resolve their tax obligations for less than the total sum required, especially for those experiencing financial difficulties.

To navigate these options effectively, consider consulting with tax relief companies that can provide guidance on the best strategies for your specific situation. By taking proactive steps and leveraging IRS assistance, you can work towards resolving your tax debts and avoiding further complications. Remember, you are not alone in this journey; we're here to help you every step of the way.

Conclusion

Navigating tax obligations and debt can feel overwhelming, but remember, you are not alone in this journey. The right tax relief companies are here to provide the support you need to regain control over your financial situation. This article highlights ten reputable tax relief companies that utilize innovative strategies, including AI-driven solutions and personalized planning, to help individuals manage their tax burdens effectively.

We understand that each person's circumstances are unique. Throughout the article, key insights into each company reveal their distinct offerings—from Turnout's AI-powered advocacy to the educational resources provided by ALG Tax Solutions, and the tailored services from Tax Defense Network and Instant Tax Solutions. Each company is committed to transparency, customer support, and personalized strategies that empower clients to tackle their specific tax challenges. It's important to grasp the nuances of IRS programs and seek professional guidance, especially as tax regulations continue to evolve.

As financial pressures mount, taking proactive steps toward resolving tax obligations is essential. Engaging with these tax relief companies can lead to significant improvements in your financial health. Explore the options available to you, and don't hesitate to reach out for assistance when needed. Remember, navigating tax issues is a journey, and with the right support, you can find relief and work towards a more stable financial future.

Frequently Asked Questions

What is Turnout and how does it help with tax debt relief?

Turnout is an AI-powered platform that assists users in navigating tax obligations and government benefits, making the process of dealing with tax issues more manageable and efficient.

How does Turnout utilize technology in its services?

Turnout employs advanced technology to streamline the tax relief process, ensuring users receive timely support and guidance, while also empowering them to take control of their financial situations.

What types of services does Turnout offer?

Turnout offers both complimentary options and services with necessary fees, including assistance with tax debts and Social Security Disability claims, provided by trained non-legal advocates and IRS-licensed enrolled agents.

Is Turnout a law firm?

No, Turnout is not a law firm and does not provide legal representation, but it offers professional support in navigating tax relief and government benefits.

How does Turnout address IRS audits?

Turnout helps reduce audit risk and enhances the ability to dispute IRS findings, particularly through programs like the Fresh Start Initiative, especially as the IRS increases its use of AI in audits.

What is the role of customer support at Turnout?

Turnout prioritizes transparency and communication, ensuring that users feel supported throughout their journey in managing tax debts and government benefits.

What are the average resolution times for tax issues with Turnout?

The average resolution time varies based on individual circumstances, but Turnout focuses on achieving the best possible outcomes through tailored support.

How does Tax Defense Network approach tax relief solutions?

Tax Defense Network provides customized solutions by thoroughly assessing individual tax situations and creating personalized plans to address specific challenges.

What specialized services does Tax Defense Network offer?

Tax Defense Network specializes in tax debt resolution, offers in compromise, and penalty abatement to help individuals facing various tax challenges.

Can you provide an example of a successful program offered by Tax Defense Network?

The Innocent Spouse Relief Assistance program has effectively supported individuals in alleviating unjust tax pressures, demonstrating the tangible benefits of their services.